After backlash, govt roll back: indexation benefits available on LTCG tax on sale of property

By : Vidya

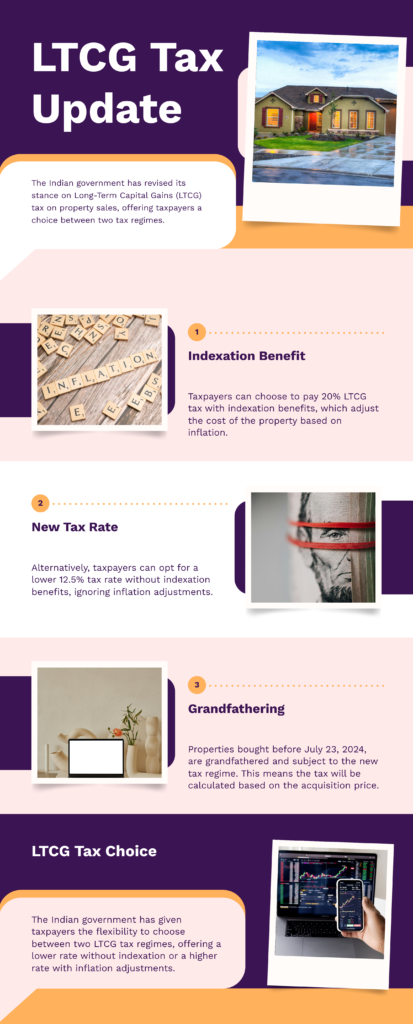

Following concerns and criticism from certain quarters over the Budget proposal of removal of indexation benefit on long-term capital gains (LTCG) on sale of unlisted assets, the government has decided to offer a choice to taxpayers in cases of sale of property acquired before July 23, 2024—pay LTCG tax at the rate of 20 per cent with indexation benefit, or pay at the new rate of 12.5 per cent without indexation benefit, as per amendments moved by the government in the Finance Bill. Taxpayers would be expected to pay the lower tax amount of the two options.With the amendments, effectively all properties purchased before the Budget presentation date—July 23—have been grandfathered. In the original proposal, there was no grandfathering for properties bought after April 1, 2001. For properties purchased before that date, the fair market value as on April 1, 2001 was to be taken as the cost of acquisition.