RBI warns: High interest and tough recovery harm microfinance borrowers

By : Sandhya

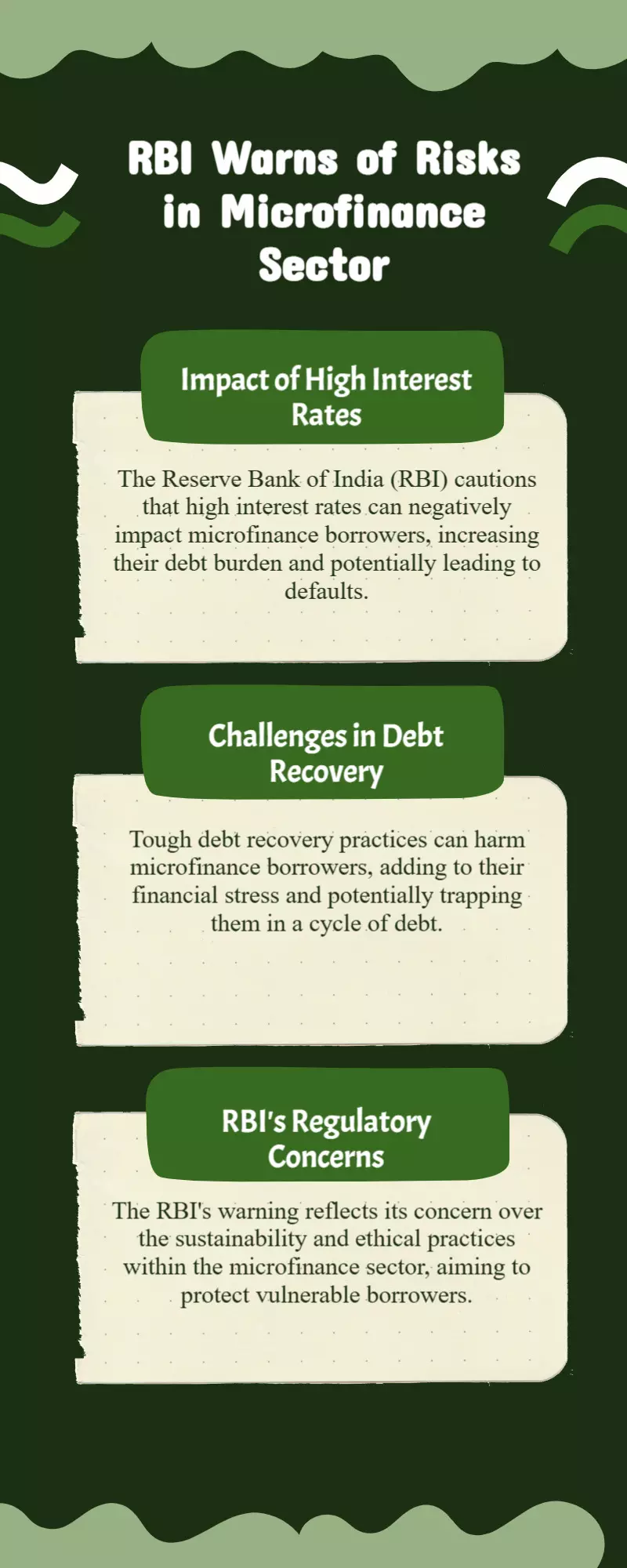

The Reserve Bank of India (RBI) has raised red flags over troubling trends in the microfinance sector, urging urgent reforms to ensure fairer treatment of vulnerable borrowers. Speaking at an event in Mumbai, RBI Deputy Governor M. Rajeshwar Rao stressed the need for a more responsible and development-focused approach from microfinance institutions (MFIs).

While acknowledging microfinance’s vital role in improving financial access for the poor, Rao expressed concern over growing issues like borrower over-indebtedness, persistently high interest rates, and harsh recovery methods. He noted that despite recent dips in lending rates and access to lower-cost funds, many MFIs continue to charge excessive margins—often seen as unjustified.

Rao criticized the shift toward a profit-centric mindset among some microfinance lenders and warned that this could undermine the sector’s social mission. He called on industry stakeholders to adopt ethical practices, ensure transparent pricing, and prioritize the long-term empowerment of economically weaker sections. Only through reform and accountability, he added, can microfinance fulfill its promise as a tool for inclusive growth.