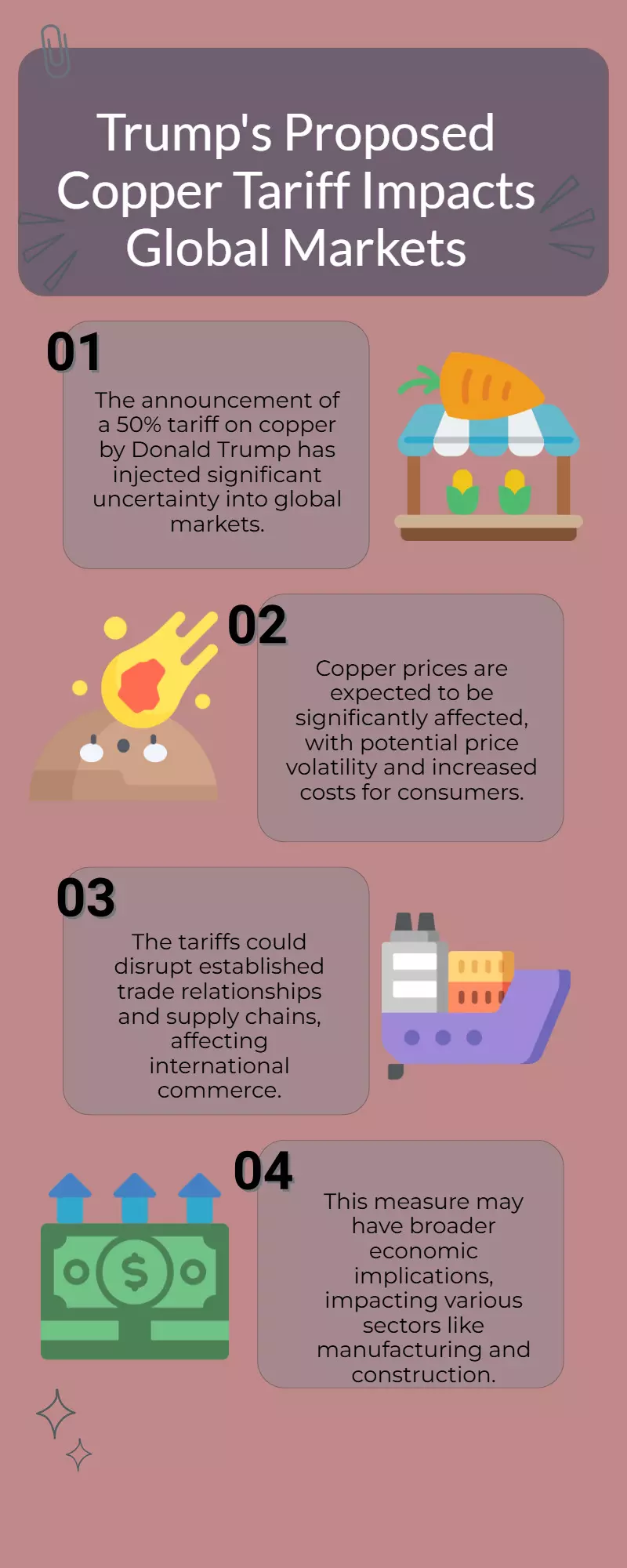

Trump's 50% Copper Tariff Sends Shockwaves Through Global Markets

By : Sandhya

President Donald Trump announced that the United States will impose a 50% tariff on all copper imports starting August 1. The decision threatens to disrupt a global supply chain for one of the key inputs for the American industry and a crucial commodity for the green technology transition.

The White House laid the groundwork for this decision as early as February 25, warning of national security risks associated with America's growing dependence on foreign copper.

The United States faces significant vulnerabilities in the copper supply chain, with increasing reliance on foreign sources for mined, smelted, and refined copper," the administration stated.

Despite having domestic copper reserves, the U.S. remains a net importer because of its underdeveloped smelting and refining capacity. Over half of global smelting is controlled by a single foreign producer, which Washington sees as a strategic threat.

Since February, U.S. copper imports have surged as traders scrambled to beat the tariff deadline. Between January and April 2025, the U.S. imported 461,000 tons of copper, 232,000 tons more than in the same period last year.

On the London Metal Exchange, this frenzy drained inventories and drove up prices. Still, spreads have collapsed recently as the arbitrage window closes and traders recognize that shipments now risk arriving after the tariff has taken effect.

Following the cabinet meeting, Commerce Secretary Howard Lutnick, who led the investigation, confirmed the tariff's timeline to CNBC.