Olectra Greentech soars 20%: Should you book profits or stay invested?

By : Krishna Mishra

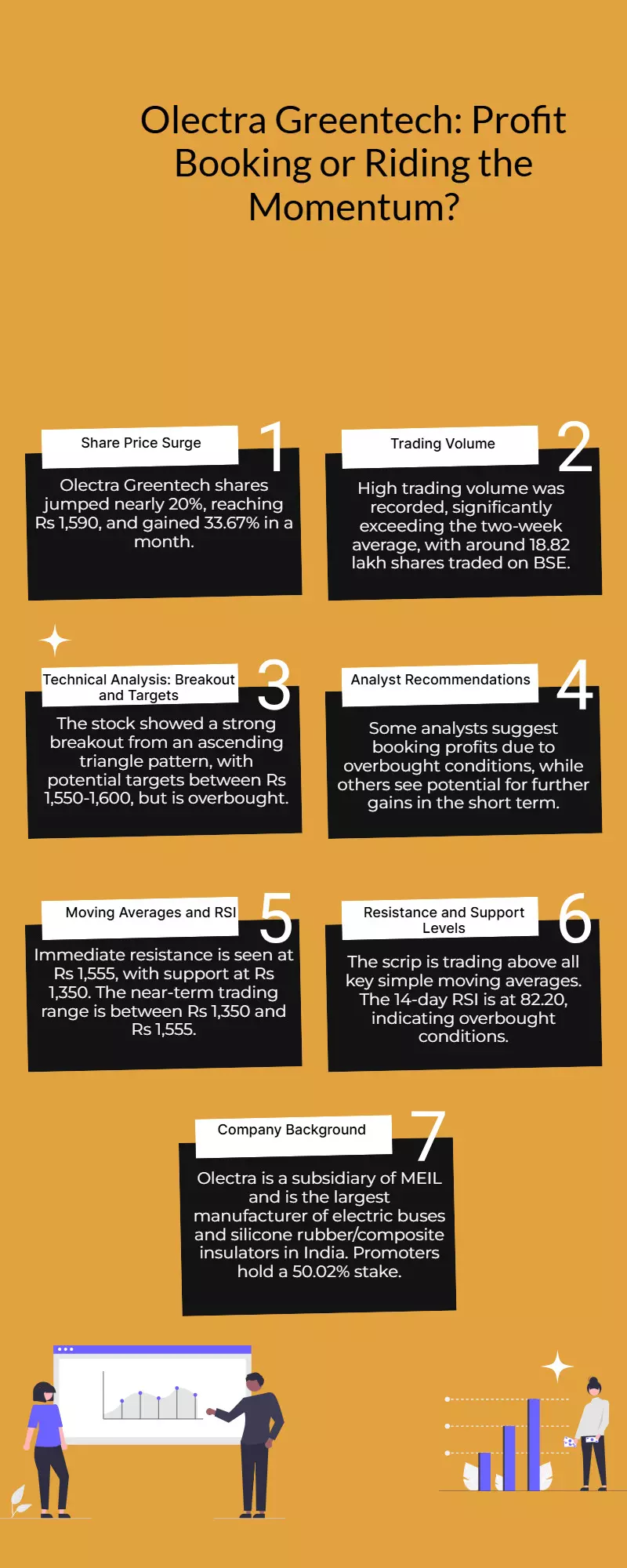

Olectra Greentech shares soared 20% in intraday trading on July 24, sparking investor curiosity about whether it's time to book profits or ride the momentum. The rally came after the company announced significant developments, including growing interest in electric buses and EV infrastructure projects. As India pushes for electrification in public transport, Olectra remains one of the top beneficiaries, being a key supplier of electric buses to various state transport undertakings.

The company’s robust order book and consistent quarterly performance have attracted both institutional and retail investors. In the past year, the stock has shown tremendous growth, backed by government policies promoting electric vehicles, higher ESG focus, and a strong commitment from the company to expand production capacity.

Experts believe that while the long-term fundamentals remain strong, the sharp spike could trigger short-term volatility. Technical analysts have also indicated that the stock is in overbought territory, which might lead to profit booking. Investors are advised to evaluate their risk appetite and investment horizon before making a move.

Brokerages remain divided. Some suggest partial profit booking at current levels to lock in gains, while others recommend holding the stock, citing a strong long-term growth trajectory driven by the EV boom and clean energy push.

In summary, Olectra Greentech’s 20% surge reflects strong market sentiment and positive business fundamentals, but investors must weigh short-term volatility against long-term potential before deciding their next move.