Tesla profit dips sharply as Musk’s political shift drives buyers away

By : Krishna Mishra

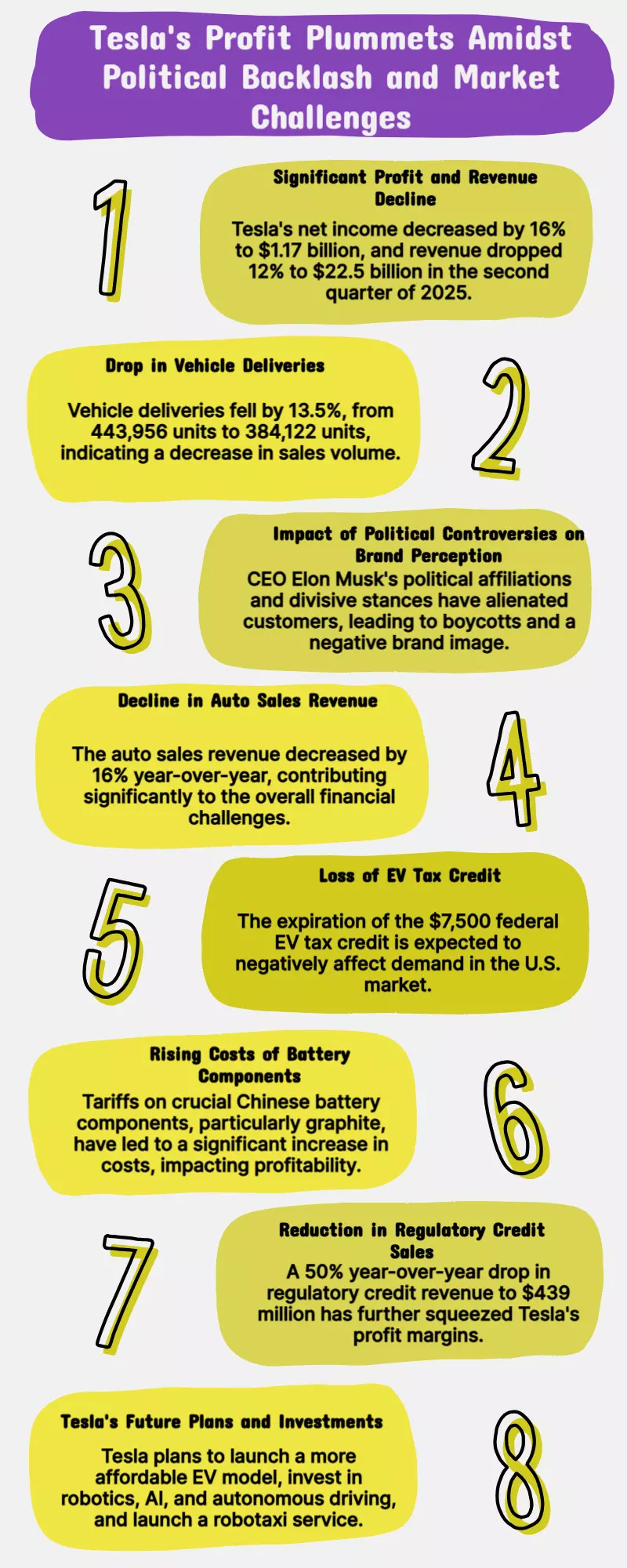

Tesla's financial struggles deepened in the second quarter of 2025, as fallout from CEO Elon Musk’s political activity continued to repel buyers across global markets. The electric vehicle giant reported a 12% drop in revenue and a 16% fall in profit for the April-June period. Buyers, both in the U.S. and internationally, have been distancing themselves from the brand, with critics blaming Musk’s increasing political alignment—especially his support for far-right candidates in Europe.

📉 Sharp Financial Declines

Tesla’s quarterly profit fell to $1.17 billion (33 cents per share), down from $1.4 billion (40 cents per share) a year ago. It marked the third straight quarter of declining profits. Revenue fell from $25.5 billion to $22.5 billion, though slightly above analysts’ estimates. Tesla’s stock dropped 3% in after-hours trading.

While adjusted earnings were in line with Wall Street expectations at 40 cents per share, analysts like Forrester's Dipanjan Chatterjee pointed to Musk’s image as the root of Tesla’s brand erosion, calling it "a toxic brand inseparable from its leader."

🤖 Focus Shifts to Robotaxis and AI

During the earnings call, Musk focused more on Tesla’s robotaxi initiative, autonomous driving software, and robotics, rather than core vehicle sales. He announced that Tesla is piloting a robotaxi service in Austin, Texas, with plans to roll out to more U.S. cities soon.

“We’re being very cautious. We don’t want to take any chances,” Musk said, adding that the service could reach half of the U.S. population by year’s end, pending regulatory approval.

Despite the excitement, concerns remain. Incidents like a robotaxi steering into an opposing lane in Austin have raised red flags. Meanwhile, Waymo continues to dominate the autonomous taxi space and recently completed its 10 millionth paid trip.

🌍 Global Sales Impacted

Musk’s controversial political leanings have turned off European buyers, affecting Tesla’s performance in markets like Germany, France, and the U.K. Competitors such as BYD (China) and Volkswagen (Germany) have capitalized on Tesla's weakening grip, gaining market share.

💸 Incentives and Carbon Credit Revenue Decline

The new U.S. federal budget has stripped away a $7,500 EV tax credit and removed penalties for breaching carbon emission limits—two key elements that previously boosted Tesla's revenue.

Tesla’s carbon credit sales fell to $439 million, nearly half of what it earned ($890 million) in the same quarter last year.

“We’re in this weird transition period where we’ll lose a lot of incentives in the U.S.,” Musk admitted. He predicted the company would experience rough months through the first half of 2026.

🚘 Affordable Model Coming, FSD Delay in Europe

To reignite sales, Tesla plans to release a lower-cost model by the end of 2025, delayed from the originally promised June timeline.

Meanwhile, Tesla’s Full Self-Driving (FSD) software rollout in Europe has also been delayed. Musk now expects regulatory approval by the end of the year, though the feature still remains a driver-assist system rather than full autonomy.

🤖 Robots Incoming: The Optimus Plan

In robotics, Musk shared plans to scale up production of Optimus humanoid robots to 100,000 units per month over five years.

“We’ll go from a world where robots are rare to where they’re so common you don’t even look up,” he said.

🧾 Margins and Control

Tesla’s gross margins fell to 17.2%, down from 18% last year. A silver lining was the company’s bitcoin investment, which yielded a $284 million paper gain this quarter.

When asked about his control over Tesla, Musk said he wanted to maintain enough ownership (currently 13%) to steer the company in the right direction—but “not so much that I can’t be thrown out if I go crazy.”