Govt tables insolvency bill to speed up resolution process

By : Krishna Mishra

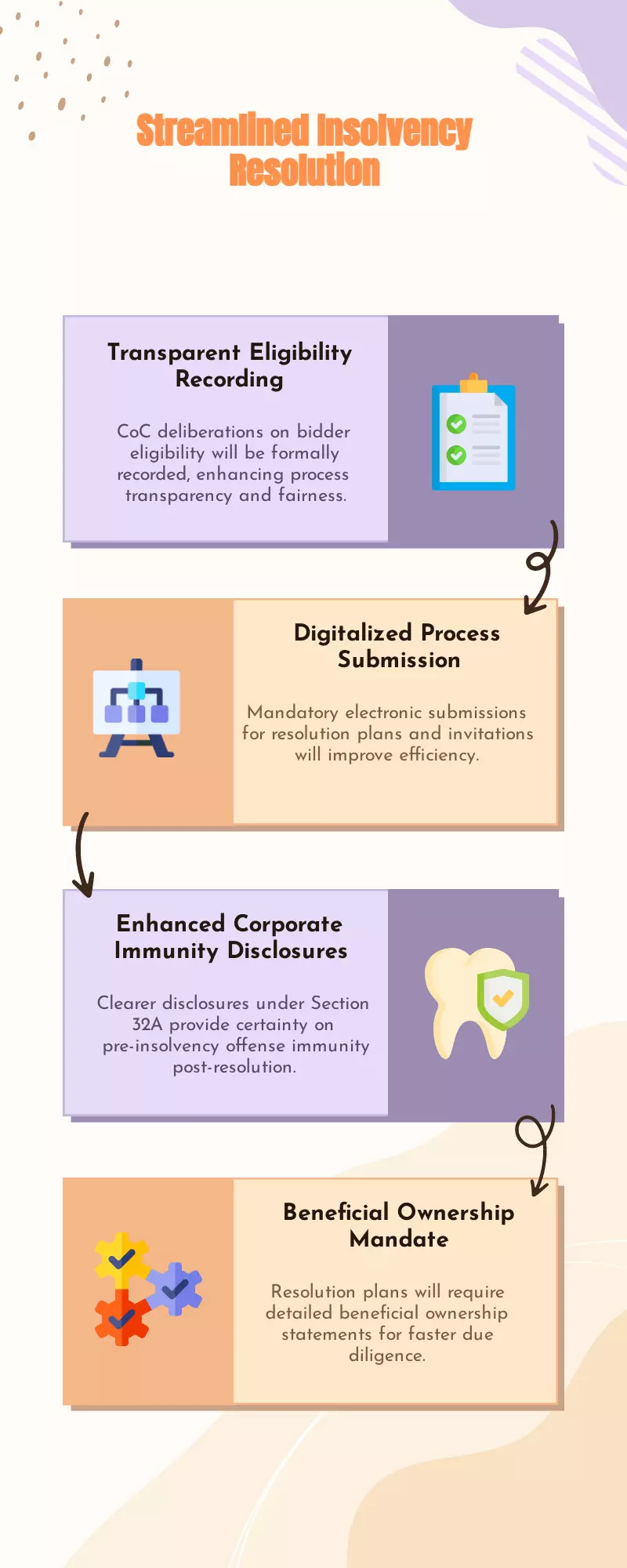

On August 12, the government introduced the Insolvency and Bankruptcy Code (Amendment) Bill, 2025, in the Lok Sabha, proposing significant changes to streamline the insolvency process and improve governance. Finance and Corporate Affairs Minister Nirmala Sitharaman, who tabled the bill, said the amendments aim to reduce delays, maximise asset value, and enhance the efficiency of all processes under the Code. The bill has been referred to a select committee of the House at the minister’s request.

Key proposals include an out-of-court mechanism for resolving genuine business failures, a creditor-initiated insolvency process, and new frameworks for group and cross-border insolvency. The out-of-court process would allow select financial institutions to initiate insolvency with approval from unrelated lenders, while the corporate debtor continues managing operations under the supervision of a resolution professional with veto powers. The framework includes a 30-day objection period, with the adjudicating authority able to convert the process into the standard Corporate Insolvency Resolution Process (CIRP) if conditions such as failure to resolve within 150 days are met.

The group insolvency framework seeks to coordinate proceedings for companies within complex corporate structures, aiming to reduce value loss and improve creditor recoveries through joint decision-making. The cross-border framework is designed to align India’s practices with global standards, protect stakeholders in domestic and foreign proceedings, and enhance recognition of Indian insolvency resolutions abroad.

According to officials, the reforms are intended to ease the burden on the judiciary, support the ease of doing business, and improve access to credit while ensuring faster admission, resolution, and liquidation of cases.