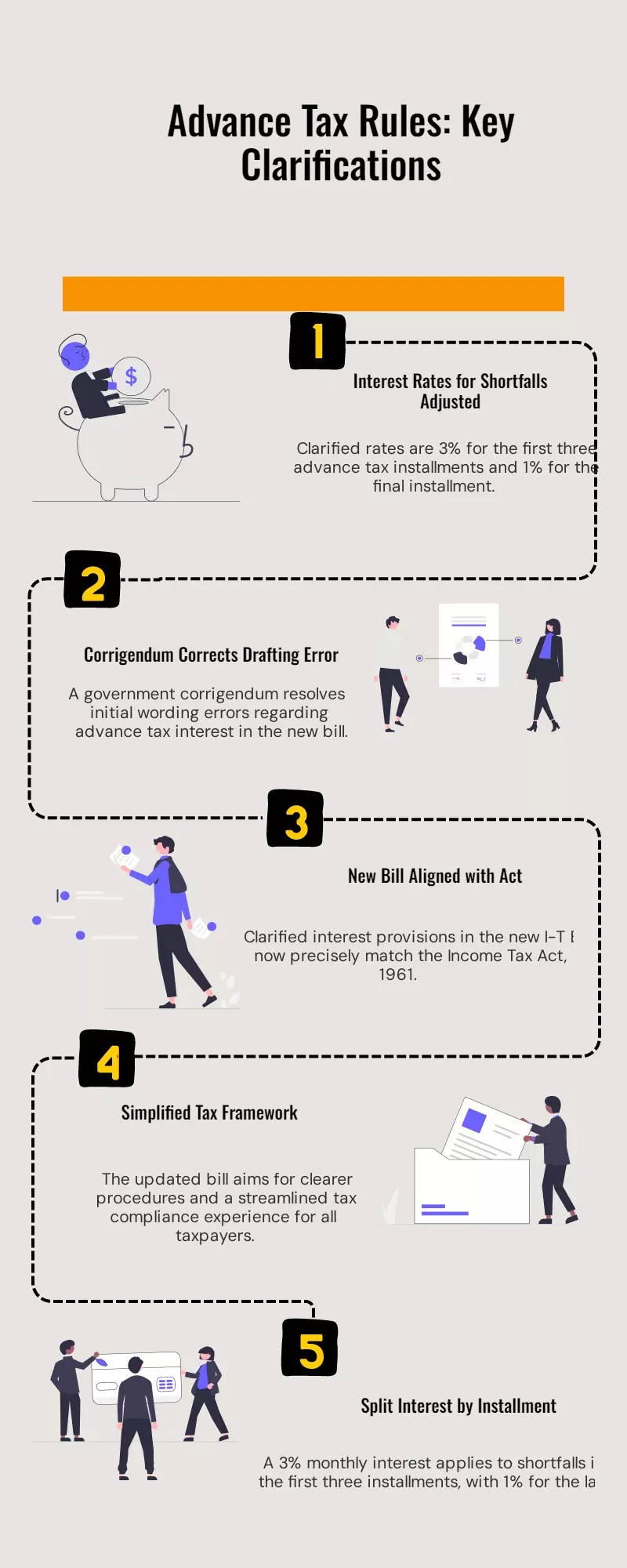

New I-T Bill: Govt clarifies rules on advance tax interest

By : Krishna Mishra

On August 12, the Finance Ministry issued a corrigendum to the new Income-Tax Bill, 2025, clarifying how interest will be charged on short payments of advance tax. The update specifies that a 3 per cent interest will apply, bringing the provision in line with the existing Income Tax Act, 1961.

Under current rules, taxpayers with a liability of ₹10,000 or more must pay advance tax in four instalments—on June 15, September 15, December 15, and March 15. If a payment shortfall occurs, even by a single day past the quarterly due date, interest is charged for a minimum of three months.

The original clause in the new bill stated that if the shortfall was covered by the next day after the due date, only one month’s interest at 1 per cent would apply. Tax experts noted this was inconsistent with the existing law. The corrigendum removes this inconsistency, restoring the alignment with the 1961 Act.

The clarification comes a day after the Lok Sabha passed the revised Income-Tax Bill, 2025, along with the Taxation Laws (Amendment) Bill, 2025, following their introduction by Finance Minister Nirmala Sitharaman.