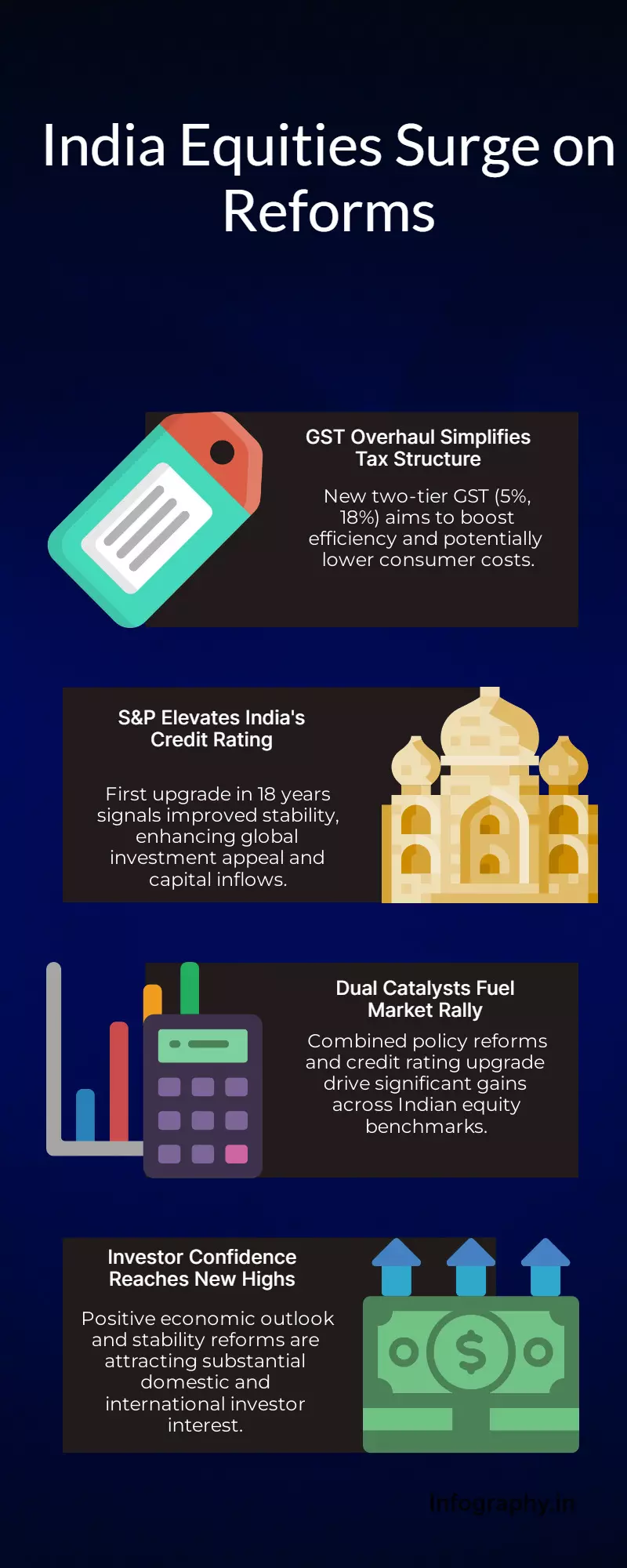

GST revamp, S&P ratings upgrade fuel rally in Indian equities

By : Krishna Mishra

Indian stock markets rallied on Monday, driven by optimism around the proposed goods and services tax (GST) revamp and the sovereign ratings upgrade from S-&P Global. The positive momentum was further supported by temporary relief for countries importing Russian oil. The Nifty 50 closed at 24,876.95 points, up by 1 percent or 245.65 points, its biggest single-day gain since May 23. The Sensex also ended higher, closing at 81,273.75 points, a rise of 0.83 percent.

Market experts noted that the GST rationalization announced on 15 August has the potential to lift consumption, though reduced tax collections in the short term could put pressure on government finances. Chirag Mehta, chief investment officer at Quantum Mutual Fund, said that the long-term expectation is that rising consumption will ultimately make India’s growth story more sustainable.

Sectors linked to consumption led the rally, with auto, consumer durables, and real estate stocks recording strong gains. Aparna Shanker, CIO of The Wealth Company Mutual Fund, said that the reduction in GST slabs from four to two is expected to benefit industries such as insurance, consumer durables, auto, and cement. However, other analysts cautioned that demand for automobiles could be temporarily affected, as customers may delay purchases until there is clarity on when the new GST rates will come into effect. This uncertainty could also influence sales during upcoming festivals like Ganesh Chaturthi and Onam.

Manufacturers, anticipating demand shifts, have already begun building inventories ahead of the festive season, which may pose challenges if buyers hold back. Prime Minister Narendra Modi, in his Independence Day address, assured that GST reforms would be implemented by Diwali as a “Diwali gift” aimed at reducing taxes on essential goods. The announcement came just a day after India received its first sovereign ratings upgrade from S-&P Global Ratings since 2007, further boosting market sentiment.

Despite the domestic rally, foreign institutional investors remain cautious. According to Bloomberg data, FIIs pulled out -$182.9 billion in August and -$285.2 billion in July. A survey by BofA Global Research also placed India at the bottom of the list of preferred Asian markets, behind Japan, China, Taiwan, and Korea. Analysts linked this cautious stance to external uncertainties, including U.S. President Donald Trump’s proposed 50 percent tariff on Indian goods.

Broader market indices also reflected the upbeat sentiment, with the Nifty Midcap index closing 1.9 percent higher at 21,267.05 and the Nifty Smallcap index rising 1.33 percent to 16,878.7. Market watchers believe that Nifty 50 will find strong support in the 24,770 to 24,800 range, while a move above 25,050 points could trigger a rally towards 25,200.