Patna HC: GST refund limit counts from correct tax payment

By : Krishna Mishra

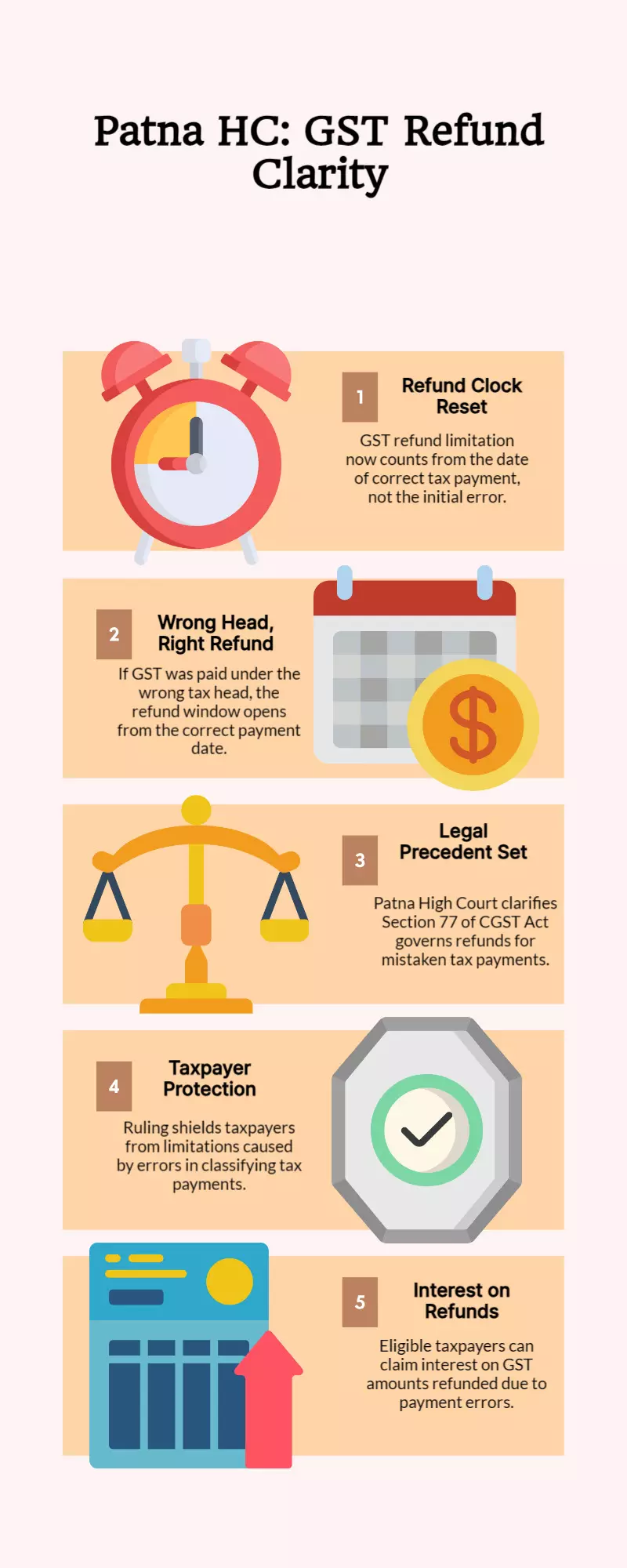

The Patna High Court has clarified that the limitation period for claiming GST refunds will begin from the date of correct tax payment, and not from the date of the original erroneous payment.

The ruling came in response to a petition where the taxpayer had initially paid tax under the wrong category and later corrected the payment. The tax authorities had rejected the refund claim, citing expiry of the statutory time limit.

However, the High Court emphasized that taxpayers should not be penalized for genuine mistakes in tax classification or payment, provided they make the necessary corrections and fulfill their obligations under the GST law. The decision reinforces the principle of substantive justice over procedural technicalities.

Legal experts say this judgment could set an important precedent for businesses facing similar issues, especially in cases of incorrect tax head selection or misclassification of goods and services. It also highlights the need for greater clarity in refund processing to avoid unnecessary litigation.

The verdict is expected to provide relief to several taxpayers and may guide future rulings on refund disputes under GST.