Can mobile phones be locked by banks if EMIs are not paid? RBI's statement

By : Sandhya

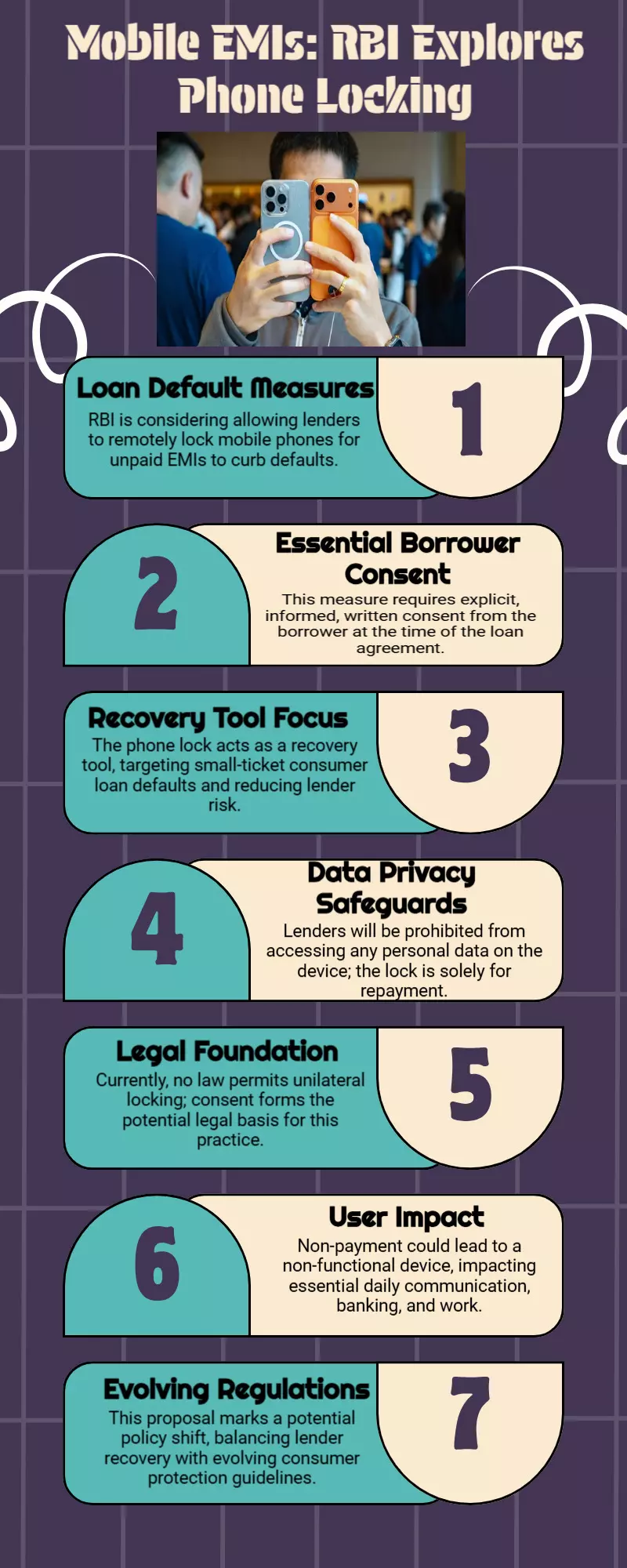

If a borrower defaults, may banks remotely lock cell phones that were bought on EMIs? On Wednesday, the Reserve Bank of India provided commentary on this discussion. During a post-monetary-policy press conference on Wednesday, RBI Governor Sanjay Malhotra stated, "Such a proposal is currently under discussion, and we are getting views both for and against such a move." "We are documenting those opinions."

The governor continued by saying, "We work to make sure that a consumer's rights are upheld, in terms of data privacy, etc." "While we take into account the challenges faced by banks, the interests of the consumer come first." In the event that a borrower defaults, the RBI is allegedly proposing to amend its Fair Practices Code to permit banks and non-banking financial institutions to remotely lock cell phones that were bought on credit through EMIs.

The new regulations would only permit locking if the borrower gave their express prior consent at the time of the loan transaction. The lock must prevent the lender from accessing or altering personal information. Particularly in the consumer electronics industry, the mechanism would serve as collateral or a kind of enforcement weapon against low-cost consumer loans.