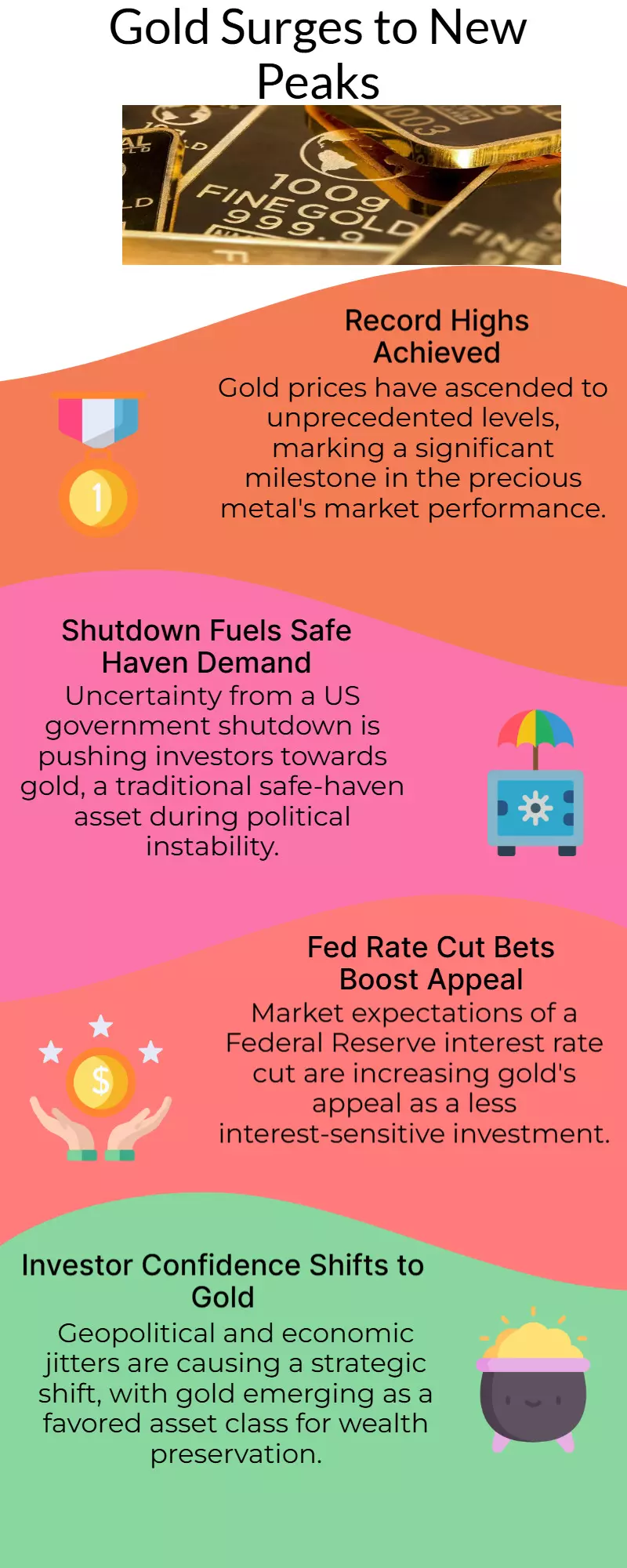

Gold prices hit a new all-time high as the US government shuts down and the Fed lowers its rate forecasts

By : Sandhya

Due to safe-haven demand during the US government shutdown and predictions of additional easing by the US Federal Reserve, gold prices on the worldwide market briefly surpassed $3,900/ounce on Monday. After peaking at $3,924.39 earlier in the day, spot gold was up 0.9% at $3,922.28 an ounce by 0208 GMT. December delivery U.S. gold futures increased 1% to $3,947.30.

"Gold was able to capitalize on the yen's weakness following the Japanese LDP elections, which left investors with one less safe-haven asset to turn to," stated Tim Waterer, Chief Market Analyst at KCM Trade. "The enduring U.S. government shutdown means that a cloud of uncertainty still hangs over the U.S. economy and the potential size of any GDP impact."

In these conditions, gold is a preferred asset for investors, especially because the Fed is anticipated to further lower interest rates this month, according to Waterer. Following the election of fiscal conservative Sanae Takaichi as the next prime minister and leader of the ruling party, the yen fell the most against the US dollar in five months.