₹1.22 lakh for gold: What proportion should you put into the precious metal portion of your portfolio?

By : Sandhya

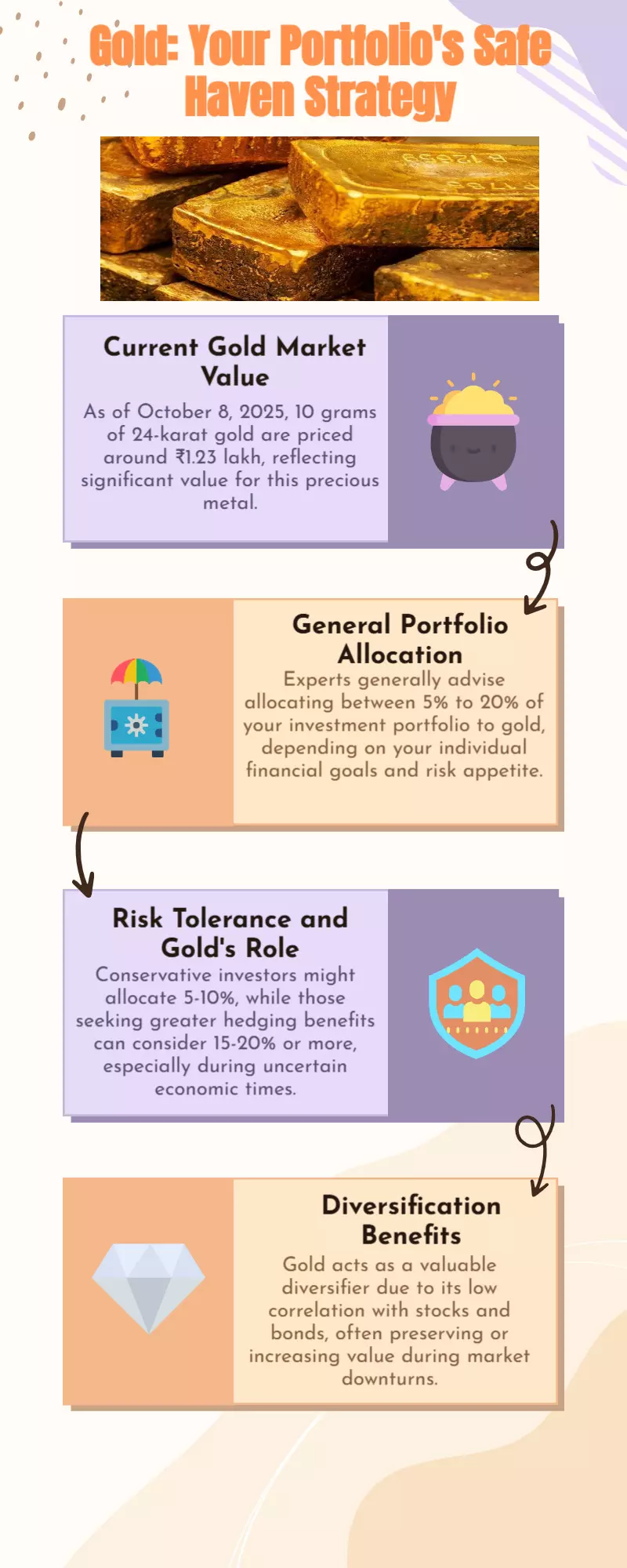

Gold recently reached its most spectacular milestone. On Wednesday, the price of gold reached a staggering ₹1,12,033 (for 22 carat) and ₹1,22,103 (for 24 carat) for 10 grams. It's more than a blip. This year, domestic gold prices have risen more than 55% due to a combination of central bank purchases, rate cut expectations, and worldwide uncertainty. This leads us to the most important question for investors: how much gold should be in your portfolio if it is already blazing this brightly?

The majority of financial experts advise investors to hold some precious metals in their portfolio. Ray Dalio, the founder of Bridgewater Associates and a multibillionaire investor, has recommended that investors put up to 15% of their portfolios in gold. When investors remain unhappy due to inflation, worldwide wars, and worries about a US government shutdown, the metal has been the go-to refuge.

Since 2022, central banks, particularly in emerging nations, have been hoarding gold in an effort to lessen their reliance on the US dollar after sanctions on Russia frozen their holdings. At the same time, gold ETFs have received significant inflows, and non-yielding assets like gold are becoming more appealing due to US Federal Reserve rate-cutting forecasts. When combined, this spike in demand has produced a strong rebound but also a conundrum: Is it too late to buy?