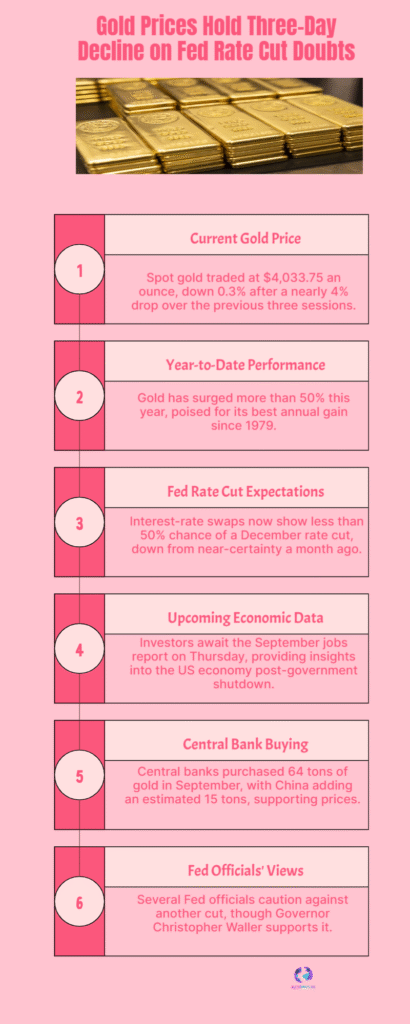

Gold Prices Decline continues for a third day as hawkish Fed comments erode December rate cut expectations. Read our Precious Metal Market Analysis on the strong US Dollar impact and the volatility outlook for bullion.

Gold Prices Decline US Fed Rate Cut Outlook

The precious metals market has witnessed a sharp reversal, with the price of gold extending its decline for a third consecutive session. This substantial pullback, which saw the metal trade near the psychologically significant $4,000 per ounce level, is directly attributable to the market’s rapidly shifting expectations regarding the US Federal Reserve (Fed) rate cut outlook.

Just weeks ago, traders were pricing in a high probability of an interest rate reduction at the December Federal Open Market Committee (FOMC) meeting. However, a series of hawkish Fed comments from key officials—who have cautioned against further monetary easing—have effectively dampened this optimism. With the US government shutdown resolved, the impending release of a deluge of delayed economic data, including the crucial September jobs report, is forcing investors to aggressively reassess the central bank’s policy trajectory.