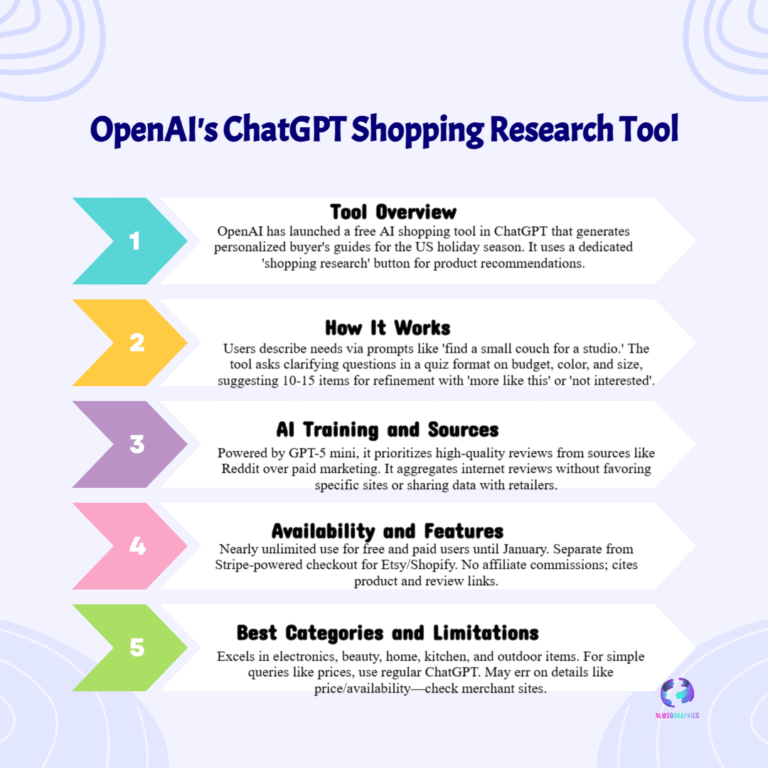

Currency forward premiums surge due to global capital outflows and high volatility, Hedging against the rupee slide towards ₹90/USD drastically expensive for importers. The RBI’s intervention faces heavy pressure.

Rupee Weakness Hedging Cost US Dollar 90

The Indian Rupee (INR) is under intense pressure against the US Dollar (USD), with market signals increasingly pointing toward the psychologically critical ₹90 per dollar mark. This escalating Rupee weakness is not only creating operational headaches for importers but is also dramatically driving up the cost of financial protection, pushing currency hedging into unaffordable territory for many businesses. For corporate treasuries, the cost of securing forward contracts—the primary tool used to lock in future exchange rates—is now reflective of massive market anxiety and high implied volatility.

The principal reason behind the rising hedging cost is the fundamental shift in forex market dynamics. When markets anticipate further and rapid depreciation, the premium demanded by banks and market makers on forward premiums surges. These premiums act as insurance against loss. With the US Dollar Nears ₹90 Mark, every day increases the market’s expectation of how far the INR will fall over the next three, six, or twelve months, making the act of buying future dollars extremely expensive for importers who rely on predictable currency flows for their global supply chains.