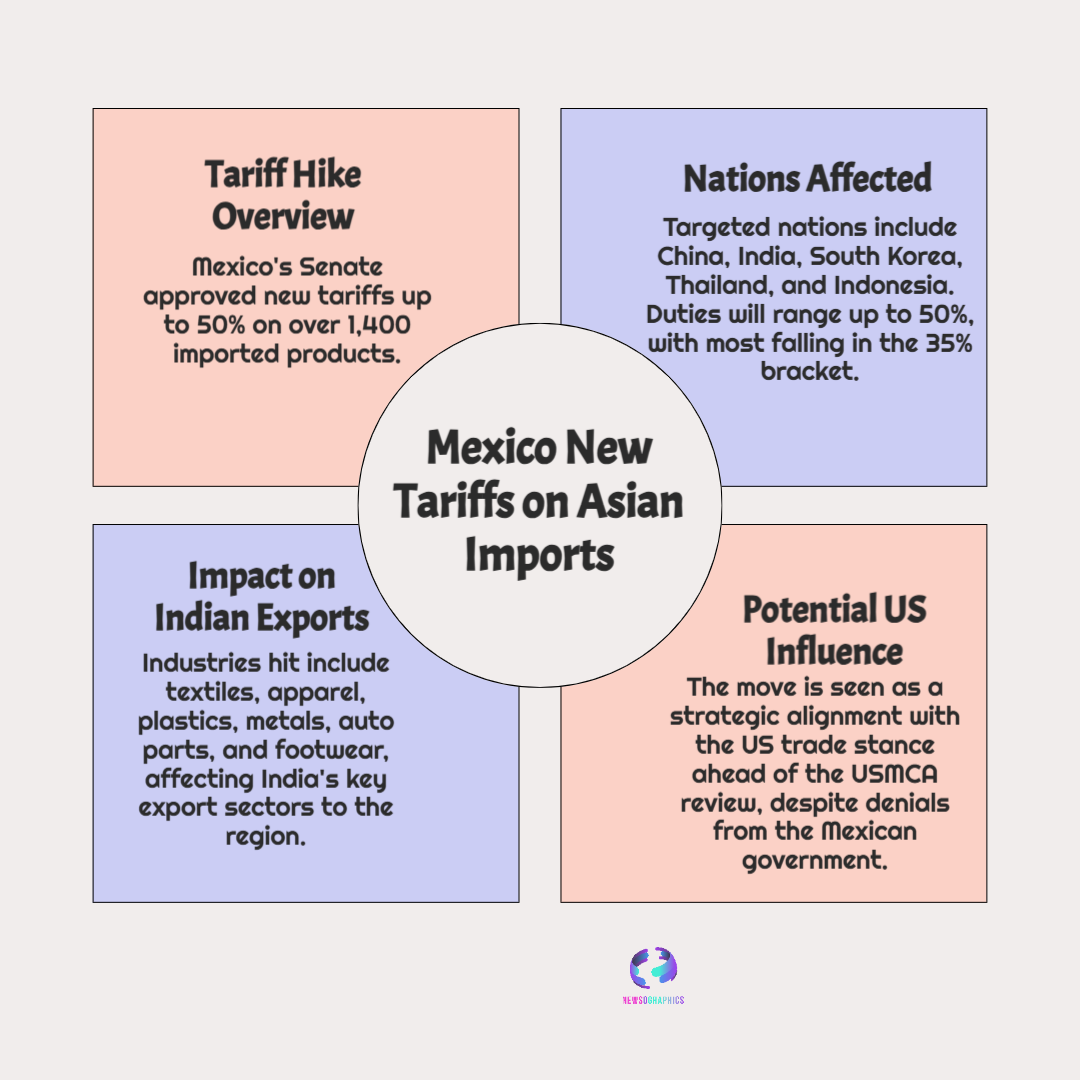

Mexico has introduced tariffs of up to 50% on goods from India, China, and other Asian nations. Explore why Mexico made this move, which sectors are most affected, and how it could reshape trade and manufacturing ties.

Mexico Tariff Shock: A Major Shift in Trade Policy

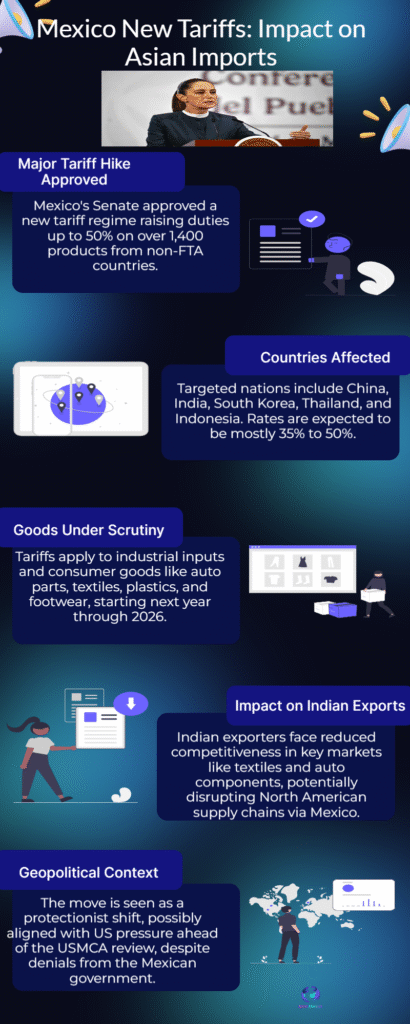

Mexico’s decision to impose tariffs of up to 50% on imports from India, China, and several other Asian economies marks one of its most aggressive protectionist moves in recent years. The announcement reflects a strategic recalibration of trade priorities as Mexico seeks to shield domestic industries, respond to competitive pressures, and align with evolving geopolitical realities.

Mexico tariff increase applies largely to countries with which Mexico does not have a free-trade agreement. India and China — both significant exporters to Mexico — fall squarely into this category, making the policy shift economically and diplomatically significant.

Why Mexico Introduced These High Tariffs

Protecting Domestic Industry

The primary stated objective is to bolster local manufacturing and prevent market saturation by low-cost imports. Sectors such as steel, automotive components, chemicals, textiles, plastics, and machinery often face intense price competition from Asian exporters.

Responding to Global Economic Pressures

With global demand fluctuating and trade tensions rising, Mexico is positioning itself to reinforce its internal industrial resilience. Many economies are adopting protectionist measures to manage inflation, support local jobs, and reduce reliance on external supply chains.

Aligning with Broader Geopolitical Shifts

Mexico tariffs move also aligns with the growing global trend of countries recalibrating their trade dependencies. While not explicitly stated, the decision appears influenced by international dynamics that prioritise nearshoring, regional manufacturing ecosystems, and diversified sourcing away from certain Asian markets.

Which Sectors Are Most Affected

Automotive and Auto Components

India and China have become increasingly important suppliers of both finished vehicles and components. Higher tariffs may directly affect the affordability and competitiveness of imports, influencing Mexico’s auto supply chain and manufacturing ecosystem.

Steel, Metals, and Industrial Inputs

Many Asian economies are major exporters of industrial materials. Tariff increases in this category may push Mexican manufacturers to source locally or from trade partners with preferential agreements.

Textiles, Apparel, and Consumer Goods

These sectors often rely on price-sensitive imports. Tariffs could raise consumer prices while creating protective space for domestic producers.

Plastics, Electronics, and Light Engineering

These categories make up a substantial portion of India and China’s exports to Mexico. Higher duties may slow import volumes and alter sourcing strategies for Mexican manufacturers.

How India and Other Asian Nations Could Be Impacted

Reduced Export Competitiveness

A 50% tariff — even if applied selectively — significantly raises the landed cost of goods, potentially pricing many exporters out of the Mexican market.

Reevaluation of Supply Chains

Indian manufacturers may need to explore:

- alternative logistics routes,

- local partnerships within North America,

- on-ground assembly to mitigate tariff impacts.

Diplomatic and Economic Re-engagement

The tariff move could accelerate bilateral discussions on trade facilitation, market access, or potential cooperation frameworks. While a free-trade agreement remains distant, sector-specific negotiations may gain momentum.

What This Means for Mexico’s Domestic Market

Higher Local Production Incentives

The tariffs are designed to push companies toward strengthening domestic production and reducing dependence on Asian imports, especially in intermediate goods.

Potential Rise in Consumer Prices

Protectionist measures often carry inflationary risk. Higher import costs may translate into more expensive end products across various consumer categories.

Stronger Regional Integration

Mexico’s policymaking increasingly reflects the influence of North American manufacturing dynamics, particularly those tied to the USMCA region. Reduced reliance on Asian imports could further deepen Mexico–US industrial alignment.

The Global Trade Context: A Return to Protectionism

The tariff announcement fits into a broader reorientation taking place worldwide. Countries are rethinking globalisation, balancing open markets with national industrial interests. Factors shaping this trend include:

- supply chain vulnerabilities exposed by global disruptions,

- strategic competition among major economies,

- pressure to safeguard jobs and stabilize domestic industries,

- growing incentives for nearshoring and friend-shoring.

Mexico’s move is therefore not isolated—it reflects a shift in how nations navigate the tension between global trade openness and economic security.

The Road Ahead: What to Watch

Key developments that may shape the future impact of Mexico’s tariffs include:

- how India, China, and other Asian nations respond diplomatically or economically,

- whether Mexico introduces sector-specific exemptions or adjustments,

- the reaction of domestic manufacturers and multinational companies operating in Mexico,

- shifts in supply chain strategies among global exporters targeting North America,

- potential ripple effects on regional and international trade relationships.

As global trade becomes more polarized and competitive, Mexico’s tariff decision may serve as a benchmark for similar protectionist recalibrations elsewhere.