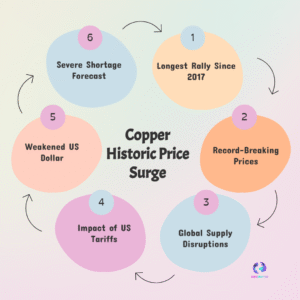

Copper prices have recorded their longest rally since 2017, driven by supply constraints, demand optimism, and renewed bullish sentiment in global commodity markets.

Renewed Momentum in the Copper Market

Copper has staged its most sustained upward movement in more than seven years, marking a decisive shift in market sentiment. The extended rally signals a return of confidence among traders and institutional participants who had remained cautious amid global economic uncertainties. This resurgence places copper firmly back in focus as a bellwether for industrial health and macroeconomic momentum.

The rally’s duration, rather than a single sharp spike, has become its defining feature. Steady gains across multiple sessions indicate broad-based participation rather than speculative bursts, reinforcing the perception that the upswing is structurally supported.

Why Copper Matters to the Global Economy

It occupies a unique position in the commodity ecosystem due to its extensive industrial applications. From construction and power generation to electric vehicles and renewable energy infrastructure, its demand profile mirrors global growth cycles.

Industrial and Infrastructure Linkages

Copper consumption rises with expansion in housing, transportation, and manufacturing. When prices trend upward for prolonged periods, markets often interpret it as a signal of stabilizing or accelerating industrial activity across key economies.

The Energy Transition Effect

The global push toward electrification has amplified copper’s strategic importance. Renewable energy grids, charging infrastructure, and electric mobility require significantly higher copper inputs compared to traditional systems, anchoring long-term demand expectations even amid short-term volatility.

Supply Constraints Tighten the Market

One of the strongest undercurrents behind the rally has been persistent supply-side pressure. Production challenges in major mining regions, combined with declining ore grades and delayed project pipelines, have narrowed the gap between supply and consumption.

Logistical constraints and operational disruptions have further limited the availability of refined copper, creating a market environment where even modest demand improvements translate into price strength.

Bullish Sentiment Takes the Lead

Market psychology has played a critical role in extending the rally. As copper prices crossed key technical thresholds, momentum-driven buying reinforced the upward trend. Bulls regained control as confidence grew that downside risks were increasingly priced in.

This shift has been reflected not only in spot prices but also in futures positioning, where longer-term contracts have attracted renewed interest. The rally’s persistence suggests that optimism is no longer confined to short-term trades but embedded in broader market expectations.

Macroeconomic Signals and Currency Dynamics

Global monetary conditions have also influenced copper’s trajectory. A softer bias in major currencies and easing inflation fears have reduced pressure on commodity prices. For dollar-denominated metals like copper, currency movements often act as a secondary catalyst, enhancing gains when macro conditions align.

At the same time, expectations of stable industrial demand from emerging economies have offset concerns about uneven growth in developed markets, keeping the overall balance tilted toward the upside.

How This Rally Compares to 2017

The last time copper experienced a rally of similar duration, it coincided with synchronized global growth and aggressive infrastructure spending. While the current environment differs, the parallel lies in sustained optimism rather than episodic spikes.

Unlike earlier cycles driven primarily by construction booms, the present rally draws strength from a more diversified demand base, including clean energy and advanced manufacturing. This diversification lends resilience to the trend, even as individual sectors fluctuate.

Implications for Commodity Markets Ahead

Copper’s extended rally carries implications beyond the metal itself. As a leading indicator, its performance often shapes sentiment across the broader commodities complex. Prolonged strength can encourage reallocation toward industrial metals and signal renewed risk appetite in global markets.

While short-term corrections remain part of any commodity cycle, the length and consistency of this rally suggest a recalibration of copper’s price floor rather than a transient surge. The market narrative has shifted from caution to conviction, marking a notable phase in the post-2017 commodities landscape.