According to an SBI study, the RBI may need to inject ₹1 lakh crore by March in order to preserve liquidity.

By : Sandhya

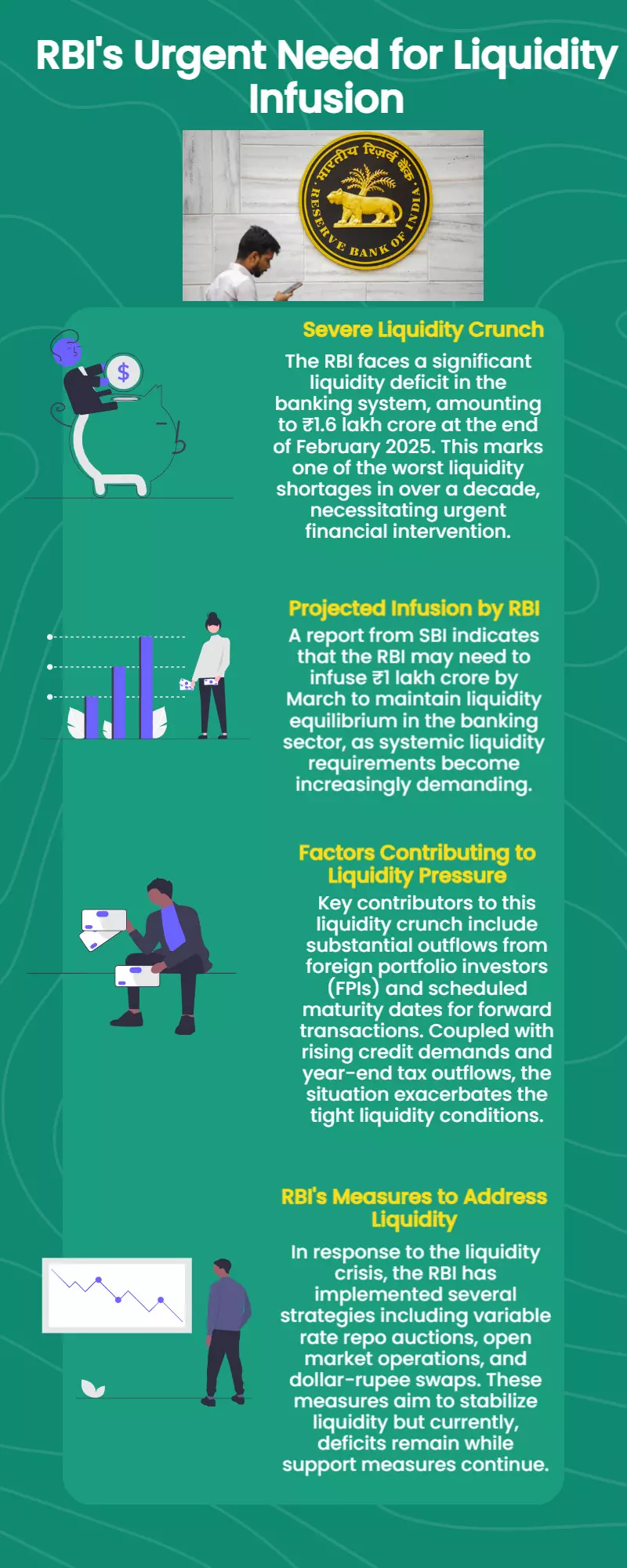

According to a State Bank of India (SBI) study, the Reserve Bank of India (RBI) could need to infuse another ₹1 lakh crore to the banking system by March in order to keep liquidity at an equilibrium level. Systemic liquidity is still tight, according to the report, with a deficit of about ₹1.6 lakh crore as of the end of February. At approximately ₹1.95 lakh crore, the average liquidity shortage is greater.

It stated that "We believe around ₹1 trillion more will be needed by March still to keep the systemic liquidity just in equilibrium..... Daily FPI outflows of significant amount and the maturing of forward transactions within 1/2/3 month and hence the RBI will need to infuse further liquidity."

The banking system has been experiencing one of the worst liquidity shortages in over ten years in recent months. Over the past few months, the financial system's liquidity situation has substantially worsened. The system's excess liquidity in November 2023 was ₹1.35 lakh crore.