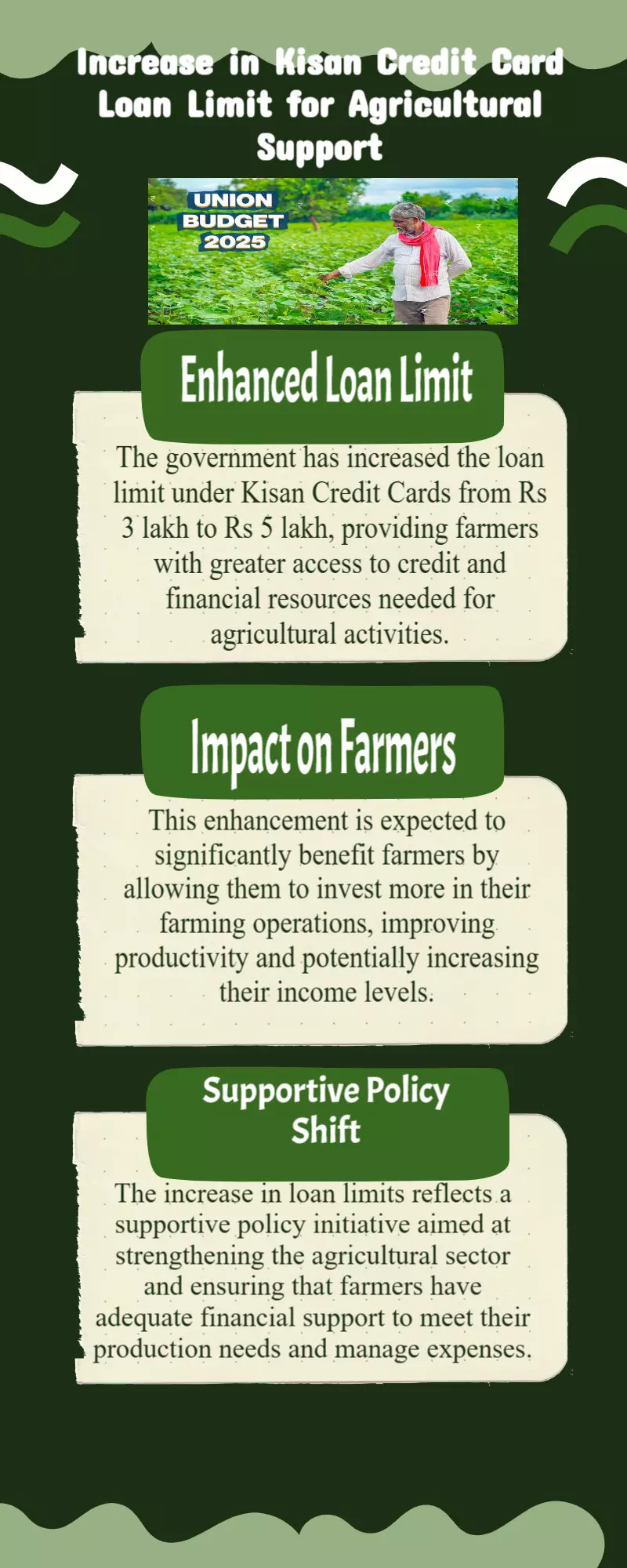

Budget 2025 LIVE updates: Loan limit under Kisan Credit Cards enhanced from Rs 3 lakh to Rs 5 lakh

By : Sandhya

The Kisan Credit Card (KCC) scheme is a government initiative in India that offers credit assistance to farmers. Established in 1998 by the Ministry of Agriculture and Farmers' Welfare, this program aims to support agriculturalists in securing financial resources.

Sandeep Chilana, Managing Partner, Chilana & Chilana Law Offices, said: “Raising the loan limit for farmers under KCC Scheme is a positive step that will give farmers better access to formal credit and reduces their reliance on high-interest informal borrowing. However, the key challenge will be ensuring smooth and quick loan disbursal, especially for small and marginal farmers. The government must also put safeguards in place to prevent over-borrowing and ensure that increased credit translates into real benefits for farmers rather than additional debt burdens.”