Income Tax Budget 2025: New income tax bill to be introduced next week

By : Sandhya

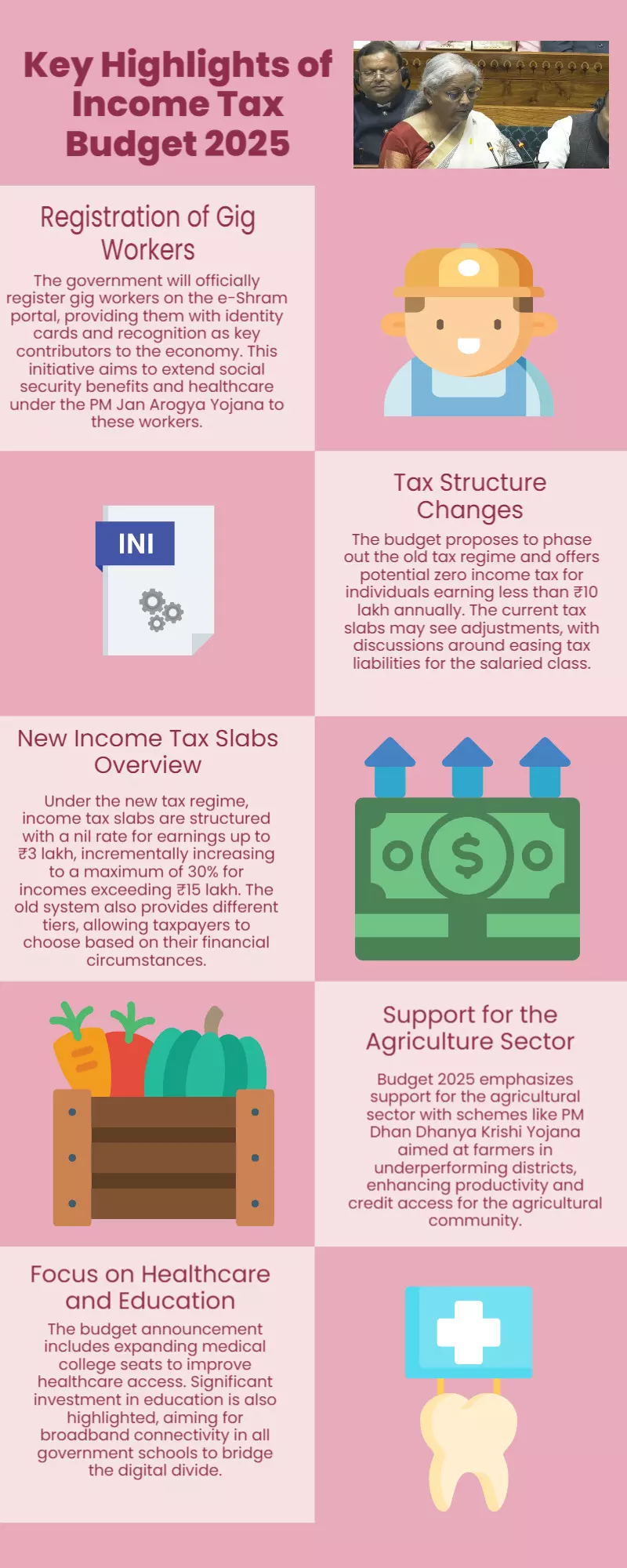

Finance minister Nirmala Sitharaman on Saturday presented the Union Budget 2025-'26 in the Lok Sabha. The budget is expected to focus more on the agriculture sector and potentially introduce some tax reforms, such as phasing out the old tax regime and introducing zero income tax for those earning less than ₹10 lakh per annum. However, this hasn't been confirmed yet.

At the moment, taxpayers can choose between two tax systems: The old tax regime, which allows exemptions on housing rentals and insurance, and the new tax regime, which was introduced in 2020 and offers slightly lower rates but doesn't allow major exemptions. Salaried taxpayers are free to choose either regime when they file their returns but for those with income from business or profession, the new regime was set as the default regime from FY 2023-24.