Old tax regime vs new tax regime with revised slabs: What to choose in 2025-26?

By : Sandhya

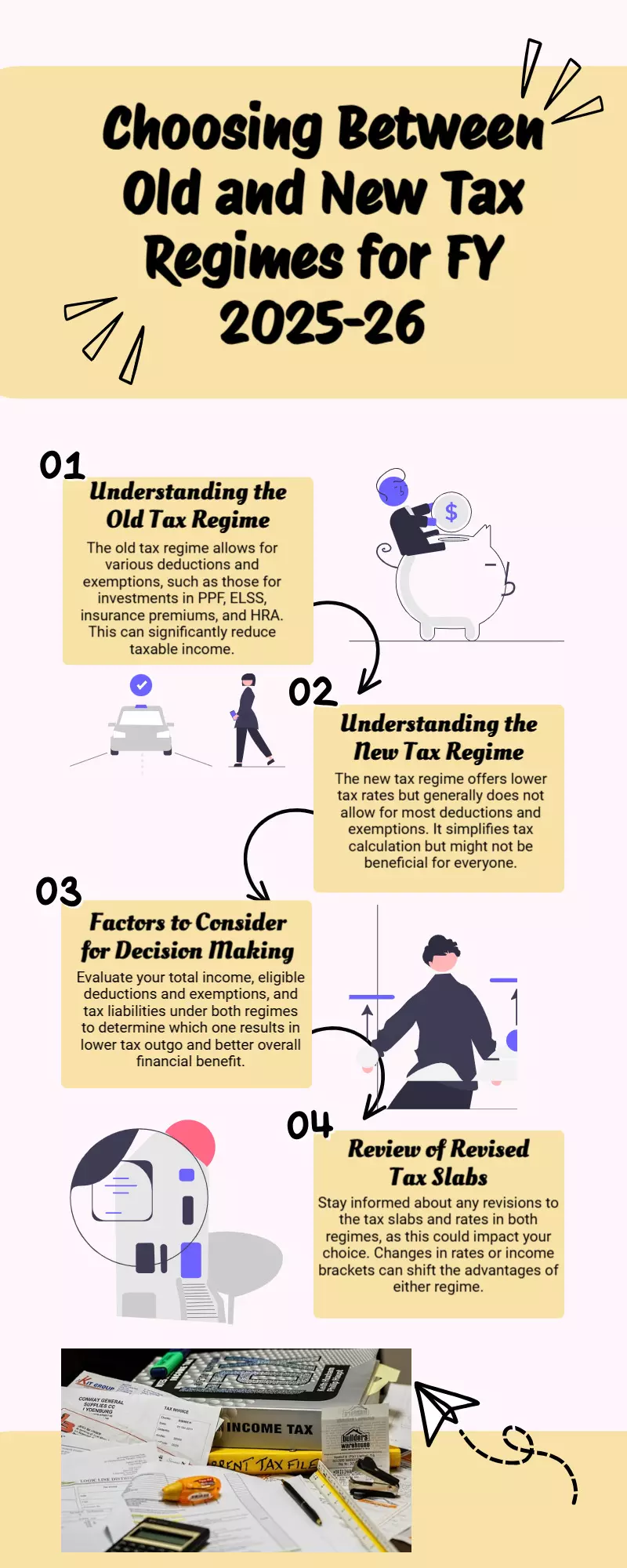

Beginning on April 1, 2025, the new income tax regime will include the redesigned tax slabs, and anyone who earn less than ₹12 lakh would not be required to pay any taxes. But only if the individual decides to adopt the new regime. Because of the numerous exemptions and deductions that the previous tax system provided in some circumstances, some people choose to stick with it.

Nevertheless, since the Union Budget 2025 has reduced the slab rates for incomes up to ₹24 lakh, many people who currently utilize the old regime should think about converting to the new one.

Although there are fewer deductions available under the new tax scheme, there is a standard deduction from salary income and a deduction for the employer's NPS payment under Section 80CCD (2). Additionally, like car leasing, telephone and conveyance reimbursements are tax-exempt under both tax regimes.