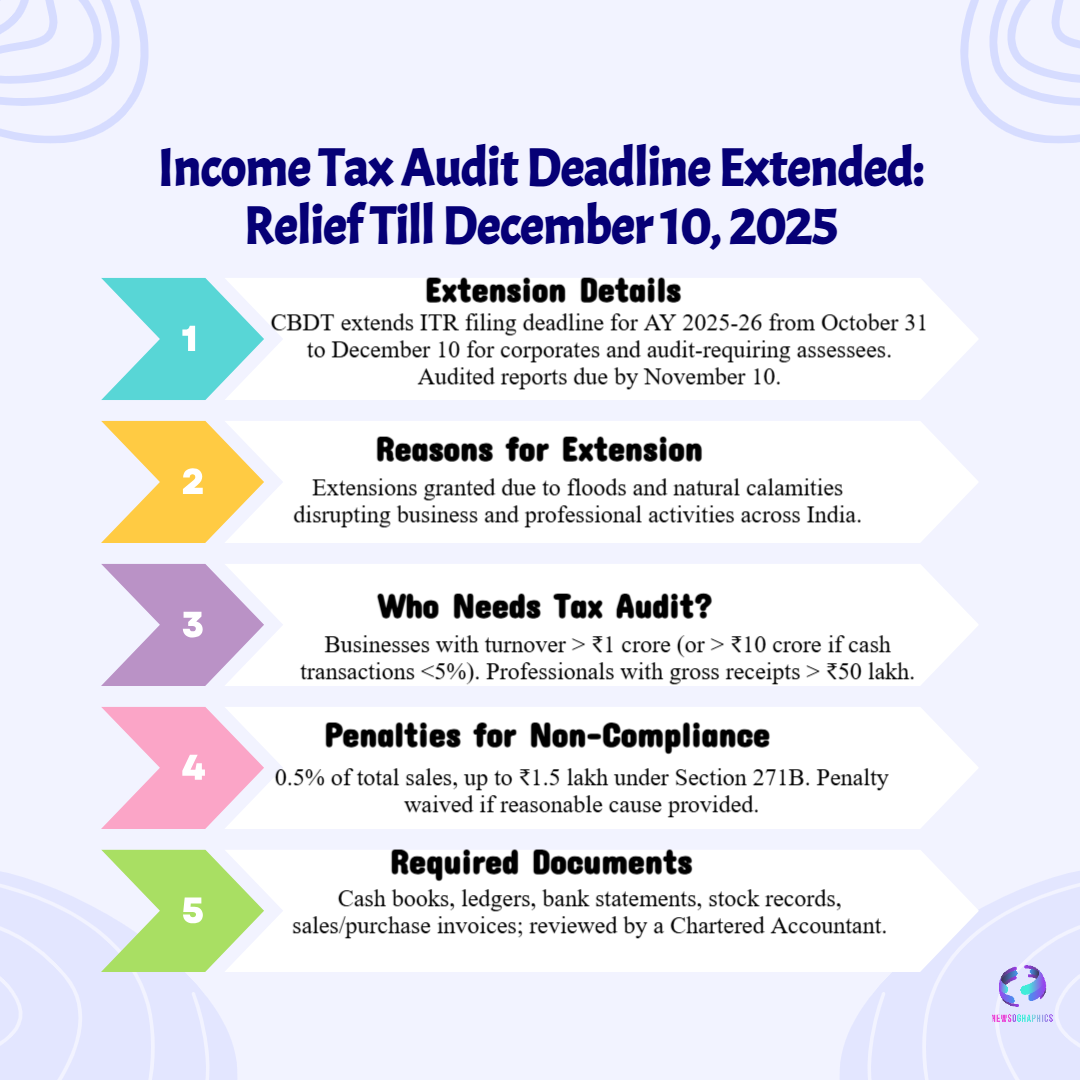

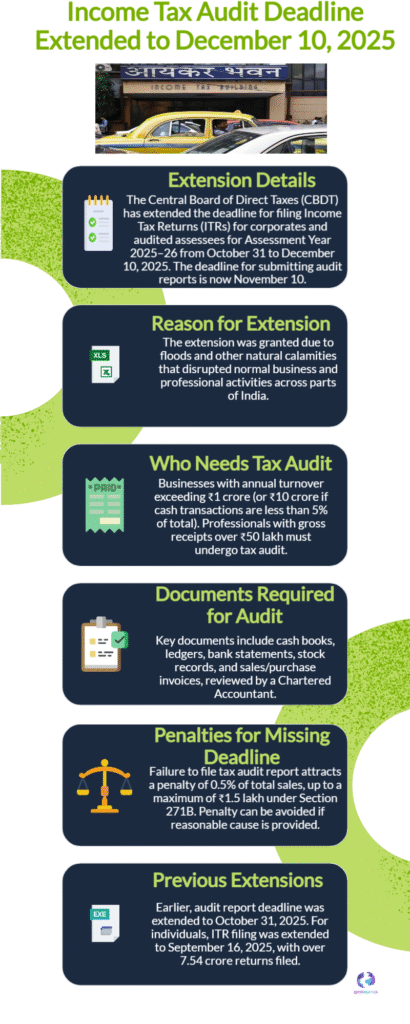

The CBDT has extended the ITR filing deadline for audit-required Income tax payers to December 10, 2025 and moved the last date for filing audited reports to November 10. Read who is affected, penalty implications under Section 271B and next steps for businesses and professionals.

CBDT Extends Income Tax Audit Deadline

The Central Board of Direct Taxes (CBDT) has extended the due date for furnishing Income-Tax Returns (ITRs) for assessment year 2025–26 from October 31 to December 10, 2025, offering relief to corporates and taxpayers who require tax audits. The deadline for filing audited reports has also been shifted to November 10, 2025. The move follows industry representations and disruptions caused by floods and other natural calamities in parts of the country.

The extension gives businesses an extra 40 days beyond the statutory October 31 deadline under the Income Tax Act, allowing chartered accountants and finance teams more time to compile audit documents such as cash books, ledgers, bank statements and stock records. Tax experts caution that despite the extension, penalties under Section 271B may apply if taxpayers miss audit deadlines — generally 0.5% of turnover subject to a maximum of ₹1.5 lakh — unless a reasonable cause can be demonstrated.

The CBDT’s decision follows earlier date changes this fiscal: the ITR deadline for many individuals was extended in recent months, while a previous one-month extension for audit reports had been granted on September 25. Official figures show over 7.54 crore ITRs filed so far and 1.28 crore taxpayers paying self-assessment tax, underscoring the scale of compliance activity this season.