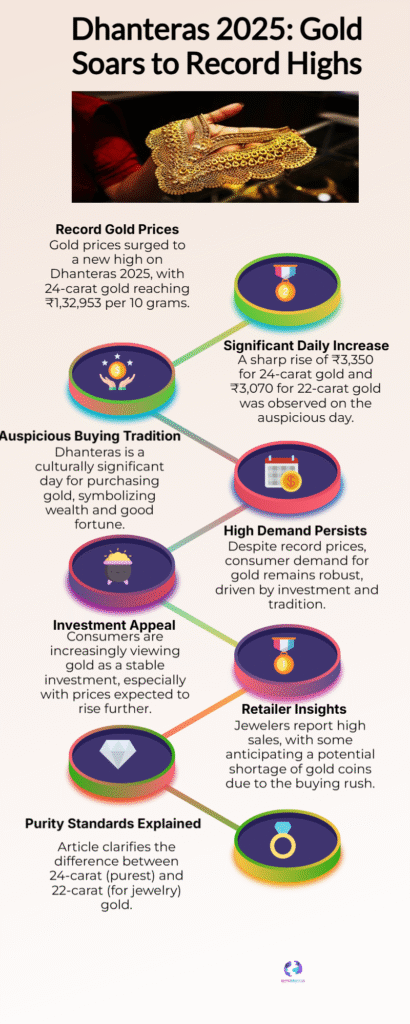

Gold prices hit record highs on Dhanteras: 24K at ₹1,32,953 and 22K at ₹1,21,883 per 10g; premiums climb, bullion shortage worries grow.

Gold demand for Dhanteras pushed prices to fresh record levels on October 18, 2025, with 24-carat gold trading at ₹1,32,953 per 10 grams — a rise of ₹3,350 — and 22-carat at ₹1,21,883 per 10 grams, up ₹3,070 as buyers snapped up jewellery, coins and bars ahead of the festival. City-specific rates mirrored the surge: Delhi, Mumbai, Kolkata, Bengaluru and Pune recorded 24K prices around ₹1.32 lakh per 10g, reflecting pan-India premium pressure driven by festive buying and constrained bullion supplies.

Jewelers and industry executives warned that persistent premiums and tight inventories could leave some stores short of coins or small bars. Titan Jewellery executives noted unusually strong footfall and inventory draws, and national chains signalled staggered availability of ready stock — a factor that could push consumers toward advance orders or metal-backed coins. Analysts say Dhanteras buying — traditionally the year’s biggest retail demand spike — coupled with global price momentum has heightened short-term tightness in the domestic bullion market.

For buyers weighing purchases, experts recommend favouring certified coins or hallmarked jewellery, comparing making charges across retailers, and considering bullion exchange or sovereign gold bonds if capital appreciation is the primary goal. With premiums elevated, shoppers buying for sentiment or gifting may prefer smaller denominations or certified coins to reduce upfront cost. Short-term traders should watch spot-dollar trends and global bullion cues, while long-term investors can spread purchases across months to average cost.

The Dhanteras price spike underscores how cultural demand, inventory constraints and market psychology converge each festive season — a pattern likely to reverberate through Diwali-week jewellery buying and aftermarket premium adjustments in the coming days.