Gold and silver prices have opened 2026 with gains, extending momentum from a powerful annual rally shaped by global uncertainty, inflation trends, and investor demand.

A Confident Opening for Precious Metals in 2026

Gold and silver entered 2026 with renewed strength, carrying forward the momentum built during an exceptional rally over the previous year. The firm opening reflects sustained investor confidence in precious metals as financial markets recalibrate expectations around growth, inflation, and monetary stability. Rather than a sudden spike, the early gains signal continuity—an extension of trends already deeply embedded in global market behaviour.

The strong start has reinforced the perception of gold and silver as resilient assets, capable of absorbing volatility while retaining long-term appeal.

The Momentum Behind the Annual Surge

Inflation Pressures and Safe-Haven Demand

One of the primary drivers behind last year’s surge was persistent concern over inflation. Even as headline numbers showed moderation in some economies, underlying price pressures continued to influence asset allocation. Gold, long viewed as a hedge against currency erosion, benefited from this environment, while silver gained from its dual role as both a monetary and industrial metal.

This inflation-linked demand did not dissipate with the turn of the year, allowing prices to open 2026 on a firm footing.

Monetary Policy Uncertainty

Shifts in global monetary policy expectations added fuel to the rally. Signals of cautious interest-rate trajectories reduced the opportunity cost of holding non-yielding assets such as gold. Silver, often more volatile, amplified these moves, reflecting speculative as well as structural demand.

The continuation of policy ambiguity has helped preserve upward pressure in the opening sessions of 2026.

Silver’s Distinctive Strength

Industrial Demand Meets Investment Interest

Silver’s performance has been shaped by more than financial sentiment alone. Expanding use in electronics, renewable energy, and advanced manufacturing supported industrial demand, while investors sought exposure to metals with growth-linked fundamentals.

This convergence of industrial relevance and investment appeal has positioned silver as a standout performer alongside gold.

Higher Volatility, Stronger Swings

Compared to gold, silver’s price movements remain sharper, responding quickly to shifts in sentiment. The opening gains of 2026 reflect this characteristic volatility, translating broader optimism into pronounced price action.

Global Factors Shaping the Early-Year Outlook

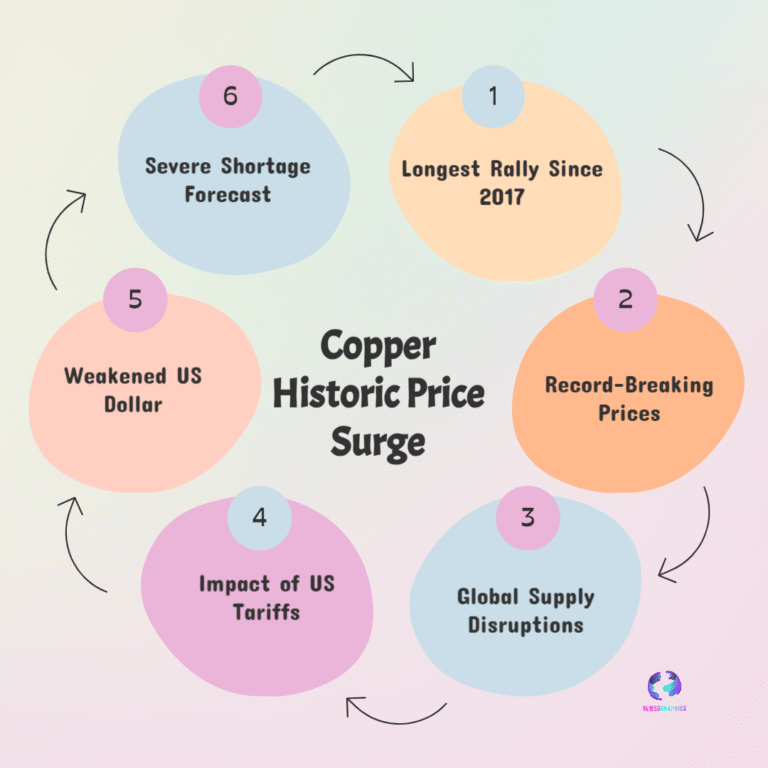

Currency Movements and Dollar Sensitivity

Precious metals remain sensitive to currency fluctuations, particularly movements in the US dollar. A relatively stable currency environment has reduced downward pressure on metal prices, allowing underlying demand to express itself more clearly.

This balance has contributed to the steady, rather than explosive, opening seen at the start of 2026.

Geopolitical Undercurrents

Lingering geopolitical tensions continue to influence market psychology. While not always visible in daily price charts, these undercurrents reinforce the appeal of tangible assets. Gold, in particular, has benefited from its role as a store of value during periods of strategic uncertainty.

Investor Sentiment at the Start of the Year

Portfolio Rebalancing and Long-Term Positioning

The transition into a new calendar year often brings portfolio adjustments. Institutional and individual investors alike appear to be maintaining exposure to precious metals, viewing them as stabilisers rather than short-term trades.

This measured approach has supported prices without introducing excessive speculative froth.

Confidence Rooted in Performance History

The scale of the previous year’s rally has also played a psychological role. Strong historical performance tends to anchor expectations, making early pullbacks less likely as confidence remains intact.

What the Strong Opening Signals

Continuity Rather Than Euphoria

The gains seen at the start of 2026 suggest continuity of trend rather than speculative excess. Markets appear to be digesting last year’s surge in a controlled manner, allowing prices to build on established support levels.

This measured advance distinguishes the current phase from short-lived rallies driven purely by sentiment.

Precious Metals in the Broader Market Narrative

Gold and silver’s firm opening places them firmly within the broader economic narrative of cautious optimism mixed with structural concern. Their performance reflects not just commodity dynamics, but a wider reassessment of risk, value, and resilience.

A Steady Start Anchored in Strong Foundations

As 2026 begins, gold and silver have reaffirmed their place in global markets. Opening the year with gains after a substantial annual surge, both metals continue to draw strength from inflation awareness, policy uncertainty, and enduring investor trust. Rather than marking an endpoint, the strong start underscores how deeply embedded precious metals have become in the current financial landscape.