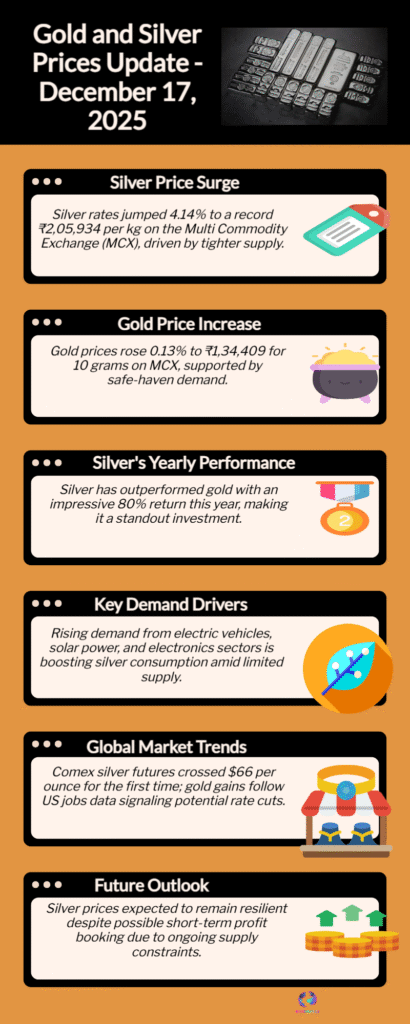

Gold and silver prices today, December 17, 2025: Explore current market trends, domestic factors, global cues, and what’s shaping precious metal movements.

Gold and Silver Prices Today: A Snapshot of the Market

Gold and silver prices on December 17, 2025, reflect a cautious but active precious metals market, shaped by a mix of global economic signals and domestic demand patterns. Investors, jewellers, and industry participants are closely tracking price movements as the year approaches its final weeks, a period that often brings heightened volatility across commodities.

While daily price changes remain measured, the broader tone of the market points to sensitivity around macroeconomic developments and currency movements, both of which continue to influence bullion rates in India.

Domestic Factors Influencing Gold Rates

Seasonal Demand and Consumption Patterns

In India, gold demand traditionally aligns with cultural and seasonal buying cycles. As the calendar moves toward the end of the year, retail interest tends to stabilize after earlier festive buying, contributing to relatively balanced price action in domestic market.

Jewellery demand, investment purchases, and institutional buying collectively influence how gold rates behave on a day-to-day basis.

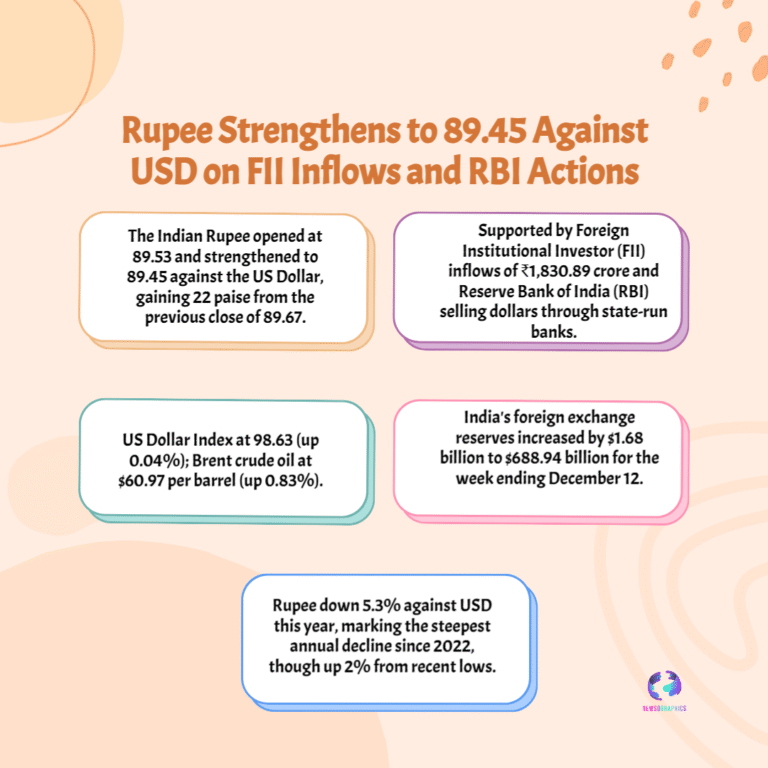

Currency Movements and Import Costs

Gold prices in India are closely linked to the rupee’s performance against major global currencies. Any fluctuation in the exchange rate can directly affect landed costs, making currency trends a key driver behind daily changes in gold rates across cities.

Silver Prices: Industrial Demand in Focus

Manufacturing and Technology Use

Silver prices today are being shaped not only by investment sentiment but also by steady industrial demand. The metal’s extensive use in electronics, renewable energy components, and manufacturing continues to support its relevance in the commodities market.

This dual role as both a precious and industrial metal often causes silver prices to react differently from gold, especially during periods of shifting economic expectations.

Market Liquidity and Volatility

Compared to gold, silver typically experiences sharper intraday movements due to thinner market liquidity. As a result, even modest changes in global cues can translate into noticeable price swings at the domestic level.

Global Cues Shaping Precious Metal Prices

Economic Indicators and Central Bank Signals

Internationally, precious metals remain responsive to economic data releases and central bank communication. Expectations around interest rates, inflation trends, and economic growth continue to guide investor positioning in gold and silver.

These global signals often filter quickly into Indian bullion markets, influencing sentiment and short-term pricing behavior.

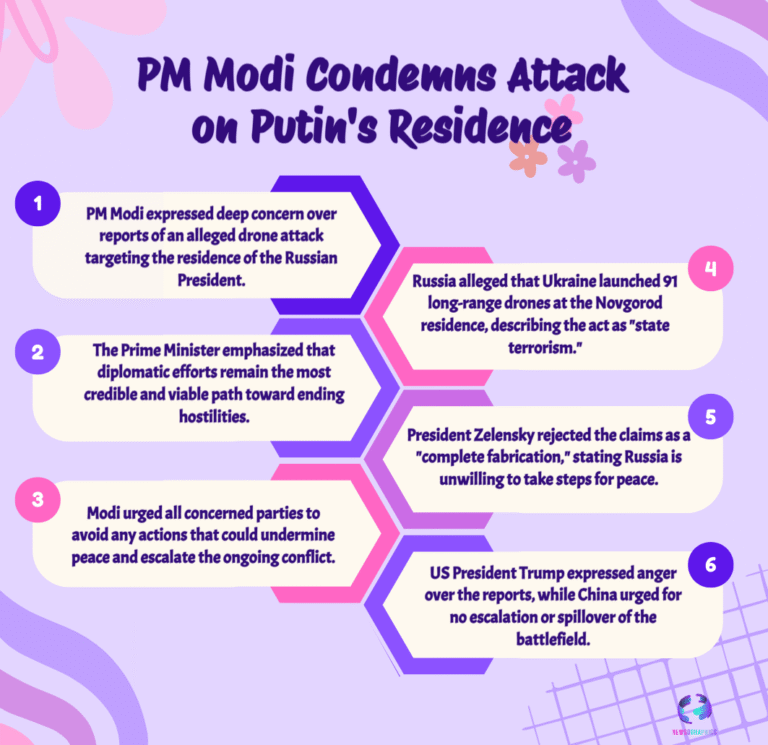

Geopolitical and Financial Market Developments

Uncertainty in global financial markets and geopolitical developments also plays a role in supporting interest in precious metals. Gold, in particular, continues to be viewed as a store of value during periods of heightened global risk.

How Market Participants Are Reading the Trends

Traders and market observers are approaching the current environment with measured expectations. Rather than sharp directional moves, the focus remains on incremental shifts driven by data and demand indicators.

For long-term participants, gold and silver continue to hold strategic importance, while short-term movements are being closely watched for cues on broader economic momentum.

Outlook for Gold and Silver Prices

As December progresses, gold and silver prices are expected to remain responsive to both domestic cues and international developments. With multiple economic factors in play, the near-term outlook points toward cautious trading rather than dramatic price swings.

Market participants will continue monitoring currency trends, global economic signals, and demand dynamics to gauge how precious metal prices evolve in the coming days.