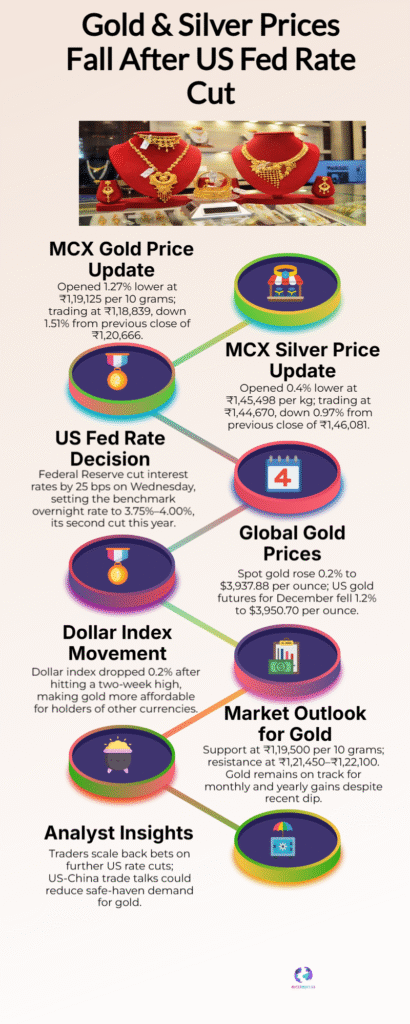

MCX gold prices fell below ₹1.19 lakh per 10 gm after the US Federal Reserve trimmed rates by 25 bps; silver declined over 1%. Experts point to a softer dollar, Fed commentary and US-China trade hopes as drivers. Read market outlook and trader tips.

Gold Prices Slip Below ₹1.19 Lakh on MCX After US Fed Rate Cut

MCX gold prices opened sharply lower on Oct. 30, 2025, slipping below ₹1.19 lakh per 10 grams as global markets reacted to the US Federal Reserve’s 25-basis-point rate cut and fresh signals that further easing may not be guaranteed. At market open, December-expiry MCX gold fell about 1.3% and silver also slid over 1%, tracking a mixed global session where the dollar retreated slightly and traders priced in shifting rate-cut expectations.

Analysts say the Fed decision reduced immediate safe-haven demand but Powell’s cautious remarks — that a December cut is “not a foregone conclusion” — capped upside for bullion, creating short-term volatility. Spot gold overseas showed modest gains while US futures traded lower, underscoring the complex interplay between dollar moves, rate outlook and geopolitics (notably US-China trade talks) in directing flows into precious metals.

Domestic technicals point to ₹1,19,500 as a near-term support for MCX December gold, with traders watching global spot levels, the dollar index and FOMC commentary for next moves. Precious-metals strategists advise investors to monitor real yields and positioning and consider staggered buying on dips if their horizon is medium to long term. Popular search queries now include: