MCX gold price drops 0.6% to ₹1,20,600 per 10 grams amid global rate cues and US dollar strength. Check reasons affecting gold, silver trends, and investment insights.

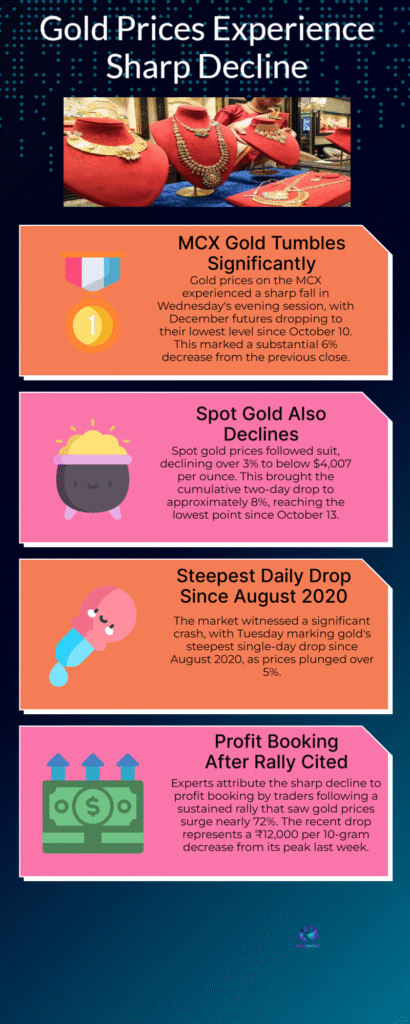

Gold prices in India witnessed a decline on October 22, 2025, with MCX gold futures falling 0.6% to ₹1,20,600 per 10 grams. Market experts cite rising global bond yields, a stronger US dollar, and profit booking by investors as primary reasons behind the drop in the precious metal. Traders noted that while safe-haven demand remains, short-term corrections are normal following a period of strong gains in gold prices over the last few weeks.

Silver prices also showed volatility, easing to ₹1,550 per 100 grams as investors shifted funds to other commodities and equities. Analysts highlight that gold and silver continue to react to global macroeconomic indicators, including US Federal Reserve policies, inflation data, and currency movements. A firmer rupee against the US dollar also weighed on domestic gold prices.

For investors, understanding the factors influencing gold prices in India is critical. These include global inflation trends, geopolitical tensions, central bank rate decisions, and local demand-supply dynamics. Jewelry demand, especially in anticipation of Diwali and wedding season, is expected to provide support to gold prices, even as short-term fluctuations occur.

Long-tail search queries likely to gain traction include “why gold prices fell in India today,” “MCX gold futures October 2025,” “gold investment trends India 2025,” and “impact of US Fed rate on gold India.” Short-tail keywords such as “gold price India,” “MCX gold today,” “silver price today,” and “precious metal trends” are embedded naturally in the article for SEO optimization.

Investors are advised to monitor both global and domestic developments closely, as gold continues to be a preferred asset for hedging inflation, wealth protection, and festive-season buying. With Diwali approaching, market experts expect increased consumer buying to stabilize gold prices in the near term.