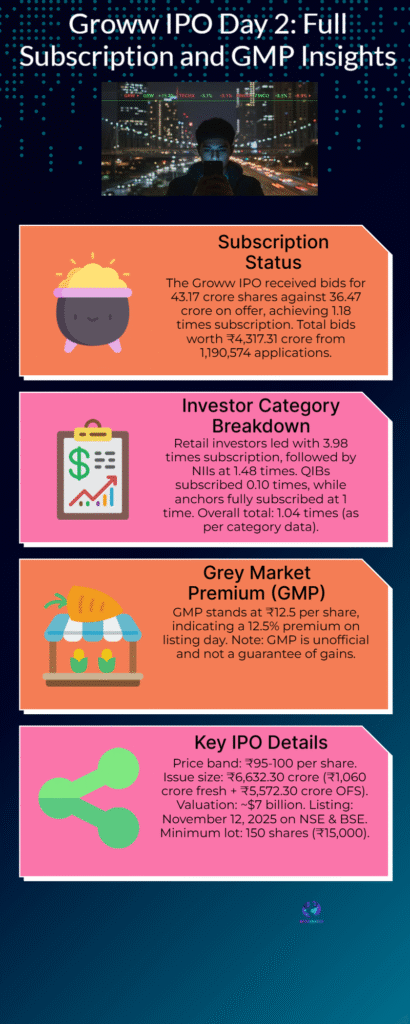

Groww IPO receives 1.18x subscription on Day 2 as retail investors drive demand; grey market premium (GMP) at ₹12.5 signals a potential 12.5% listing-day gain. Check allotment details, subscription break-up and listing date (Nov 12).

Groww IPO Fully Subscribed on Day 2

Billionbrains Garage Ventures Ltd., operator of the Groww broking platform, saw its initial public offering fully subscribed by the second day of the offer as retail investors led demand for shares. By 12:56 pm on November 6, the issue had attracted bids for 43.17 crore shares against 36.47 crore on offer, translating to an overall subscription of about 1.18 times and applications from nearly 11.91 lakh investors.

A closer look at investor category data shows stark retail enthusiasm: retail bids covered the issue 3.98 times, non-institutional investors (NIIs) subscribed 1.48 times while qualified institutional buyers (QIBs) showed limited interest at 0.10 times. Anchor investors were covered at 1x. This skew underlines a strong grassroots appetite among small investors for India’s largest direct-to-consumer broking platform.

Market chatter in the grey market placed the Groww IPO grey market premium (GMP) at around ₹12.5 per share as of late morning trading, implying a listing-day premium near 12.5%. While GMPs offer a snapshot of sentiment rather than a guarantee, the indicator suggests moderate optimism for listing-day gains among retail traders and short-term speculators. Analysts caution that GMPs are volatile and depend on demand, market mood and broader listing pipeline activity.