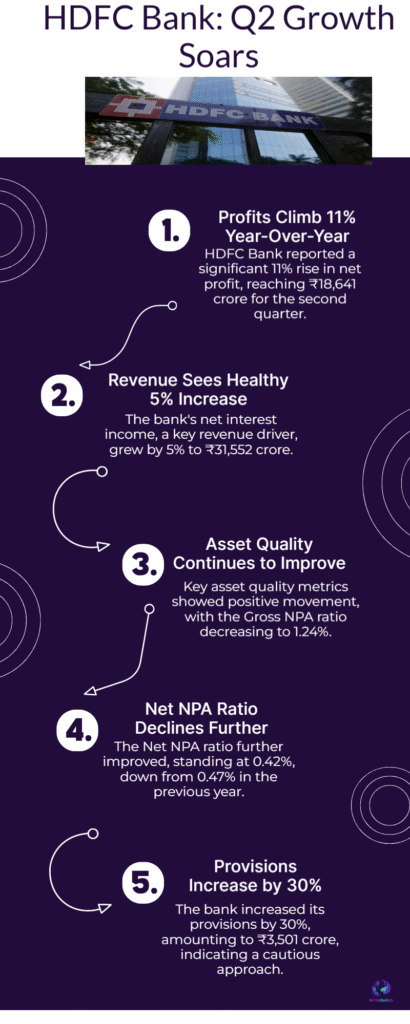

HDFC Bank posts Q2 FY26 net profit up 11% to ₹18,641 crore as NII rises 5% to ₹31,552 crore; asset quality improves, provisions jump 30%.

HDFC Bank, India’s largest private sector lender, reported a resilient second quarter for fiscal 2025-26 with net profit rising 11% year-on-year to ₹18,641 crore, driven by a 5% increase in net interest income (NII) to ₹31,552 crore in July–September. The results, disclosed in an exchange filing, underline steady core banking performance even as the bank continued to strengthen balance-sheet buffers.

Asset quality showed clear signs of improvement: gross non-performing assets moderated to 1.24% from 1.4% a year earlier, while net NPA fell to 0.42% from 0.47%, reinforcing the bank’s claim of healthier credit metrics heading into the second half. At the same time, provisions rose sharply — up about 30% to ₹3,501 crore — reflecting conservative provisioning and a focus on building coverage against potential stress.

For investors and analysts the mix matters: steady NII growth suggests margin stability even as loan growth dynamics vary across retail and corporate books. The jump in provisions will weigh on short-term earnings momentum but strengthens loss-absorbing capacity and reduces vulnerability to future slippages. Key indicators to watch in coming quarters include net interest margin, sequential loan growth in retail and micro, and the bank’s provision coverage ratio.

HDFC Bank’s Q2 performance balances durable revenue growth with prudence on asset quality. Market watchers will look for management commentary on credit trends, guidance on margins and any asset-sale or recovery updates in the next investor call. As the story develops, fresh signals on slippages, sectoral concentrations and deposit momentum will shape near-term forecasts for the bank and the broader banking index.