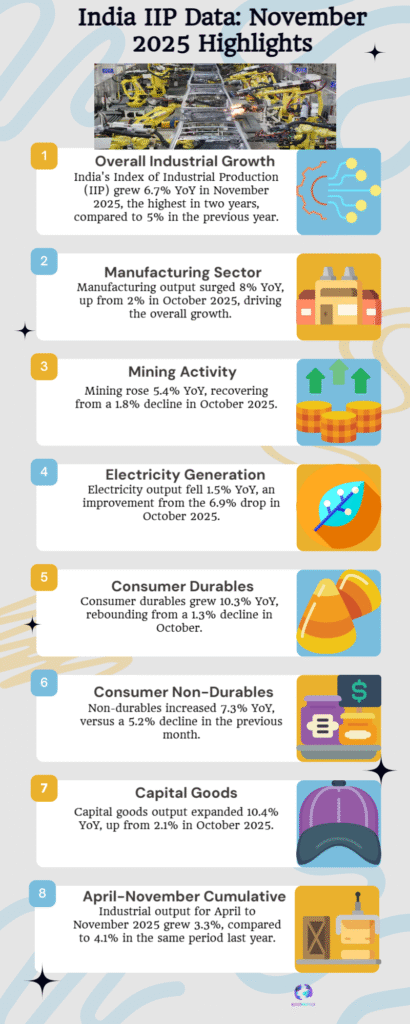

India Index of Industrial Production (IIP) data for November 2025 highlights changing trends across manufacturing, mining, and electricity, offering insights into the economy’s industrial momentum.

Understanding the Importance of IIP in Economic Assessment

The Index of Industrial Production remains one of the most closely watched indicators of India’s economic health. By tracking output across manufacturing, mining, and electricity, the IIP offers an early snapshot of how core sectors are responding to demand conditions, policy signals, and global pressures.

The November 2025 data arrives at a time when markets and policymakers are assessing the durability of growth amid uneven global recovery and domestic structural adjustments.

Overview of Industrial Performance in November 2025

Headline Movement and Broad Direction

November’s IIP figures point to a nuanced industrial landscape rather than a uniform trend. Overall output reflects moderation in certain segments alongside resilience in others, suggesting that industrial growth is being driven by selective demand pockets instead of broad-based acceleration.

This pattern underscores the evolving nature of India’s industrial cycle, where sectoral divergence has become increasingly pronounced.

Comparison with Recent Months

When viewed against preceding months, the data indicates recalibration rather than reversal. Periods of sharper expansion earlier in the year appear to be giving way to steadier, more measured growth, aligning industrial activity with realistic demand absorption.

Manufacturing Sector: Core Driver Under Scrutiny

Output Trends and Sub-Sector Signals

Manufacturing continues to anchor the IIP basket, making its trajectory central to interpretation. November’s data reflects mixed outcomes across consumer goods, capital goods, and intermediate products, highlighting differentiated demand conditions within the economy.

Capital goods performance, often seen as a proxy for investment sentiment, carries particular significance in assessing medium-term growth expectations.

Demand, Costs, and Capacity Utilisation

Manufacturing output remains sensitive to input costs, credit availability, and export demand. Any moderation visible in November suggests firms are balancing production with inventory management, especially amid uncertain global trade dynamics.

Mining and Electricity: Supportive but Uneven

Mining Sector Dynamics

Mining output contributes to industrial stability but often mirrors commodity cycles and regulatory conditions. November’s numbers suggest steady extraction activity, though growth appears constrained by logistical and environmental considerations.

The sector’s performance continues to influence downstream industries, particularly metals and infrastructure-linked manufacturing.

Electricity Generation Patterns

Electricity output offers insight into real-time economic activity. November data reflects seasonal influences alongside baseline demand from industry and households. Stability in this segment provides a cushioning effect even when other sectors show volatility.

Interpreting Sectoral Use-Based Classification

Consumer Goods Performance

Consumer durables and non-durables reveal demand-side realities. Any divergence between the two segments reflects variations in discretionary spending versus essential consumption, offering clues about household confidence.

Investment and Infrastructure Signals

India Infrastructure and capital goods data serve as forward-looking indicators. Their performance in November shapes expectations around private and public investment cycles heading into subsequent quarters.

Policy and Market Implications

Reading the Data for Policy Direction

IIP trends feed directly into monetary and fiscal assessments. Moderation without contraction allows policymakers to maintain calibrated approaches, avoiding abrupt interventions while staying alert to emerging risks.

Business and Investor Sentiment

For businesses and investors, the November data reinforces the importance of sector-specific strategies. Broad macro optimism is increasingly replaced by targeted confidence in industries aligned with infrastructure, exports, and domestic consumption resilience.

The Broader Economic Context

Domestic Factors at Play

Domestic consumption patterns, government spending rhythms, and credit conditions continue to shape industrial output. November’s data suggests that while growth drivers remain intact, momentum is being redistributed rather than amplified.

Global Influences and Trade Linkages

External demand, currency movements, and geopolitical developments continue to exert influence. India’s industrial performance reflects both insulation from and exposure to global economic shifts.

Reading Beyond the Numbers

What November 2025 Indicates About the Road Ahead

The India IIP data for November 2025 does not point to sharp inflection but rather to consolidation. Such phases often precede clearer directional movement, depending on policy continuity and demand revival.

Industrial Growth in a Phase of Adjustment

India’s industrial sector appears to be navigating a phase of adjustment rather than slowdown. The November figures reinforce a narrative of cautious resilience, where stability matters as much as speed in sustaining long-term growth.