President Trump says PM Modi assured him India will stop buying Russian oil in 2025, a claim that reverberates through trade and energy markets amid US 50% tariffs and India’s energy security concerns. Read a 600-word analysis of the claim, official responses, market impact and the diplomatic stakes.

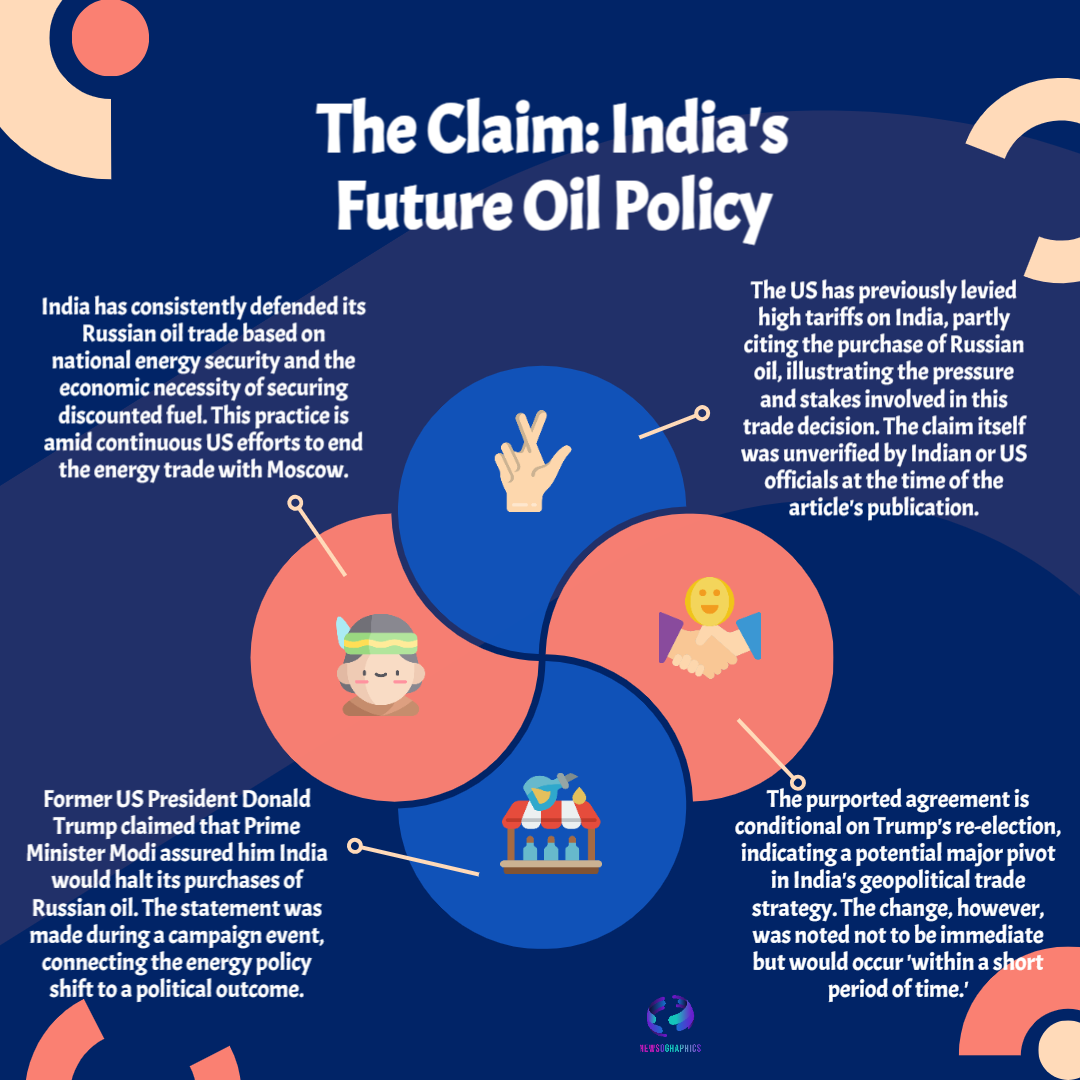

U.S. President Donald Trump told reporters on October 15–16, 2025 that Indian Prime Minister Narendra Modi had “assured” him India would stop purchasing oil from Russia — a claim that immediately captured global headlines and sent ripples through energy and trade markets. The statement came during public remarks in which Trump said the change would not be immediate but would occur “within a short period of time.”

Trump’s declaration followed a period of mounting pressure from Washington on New Delhi over its Russian crude purchases, including the imposition of tariffs of up to 50% on many Indian imports earlier this year — measures Washington says are intended to curb Moscow’s energy revenue streams. U.S. trade officials had also signalled in recent weeks that India was beginning to diversify away from Russian oil, comments that U.S. officials say point to a gradual shift in New Delhi’s buying patterns.

India has long framed its purchases of discounted Russian seaborne crude as a matter of national energy security and economic pragmatism. Officials in New Delhi have repeatedly said that sourcing cheaper oil helped keep domestic fuel prices and inflation in check while the country secures alternative supplies. Russia’s leadership warned that attempts to penalise its trade partners could backfire economically, while the Indian embassy in Washington had not immediately confirmed Modi’s alleged assurances at the time of reporting.

The claim matters for three linked reasons. First, it touches energy security: India is one of the world’s largest oil importers, and any sustained move away from Russian crude would force reconfiguration of import contracts, tanker logistics and refinery sourcing. Second, it affects geopolitics: a public pledge to cease Russian purchases would align India more closely with U.S. pressure on Moscow and reshape New Delhi’s balancing act between Moscow, Washington and Beijing. Third, it has trade consequences: the recent steep U.S. tariffs on Indian goods were explicitly tied to India’s Russian oil purchases, so any change in purchases would alter the bargaining dynamic between New Delhi and Washington.

For Indian industry and consumers, the practical pathway off Russian oil is complex. Indian refiners signed long-term discounted contracts that were economical and, in some cases, critical to maintaining refinery throughput. Transitioning away would require securing alternative cargoes — likely from the Middle East, Africa or the U.S. — and could raise import bills and domestic fuel costs in the short term.

Diplomatically, the episode underlines the intense tug-of-war over energy ties and trade policy in 2025. U.S. officials say tariffs and diplomacy are levers to pressure India and other large buyers; New Delhi so far has emphasized sovereign decision-making and economic pragmatism. Any formal commitment by India to end Russian oil purchases would likely be announced by Indian authorities after internal consultations and planning, not only in off-the-cuff remarks. At the time of reporting, Indian officials had not issued an immediate confirmation of the specific assurance Trump described.