Infosys and Wipro report Q2 results today; markets watch revenue, margins, large-deal wins and management guidance amid H-1B visa shocks and AI-driven spending uncertainty. Read a concise 600-word analysis of estimates, risks and what investors should watch.

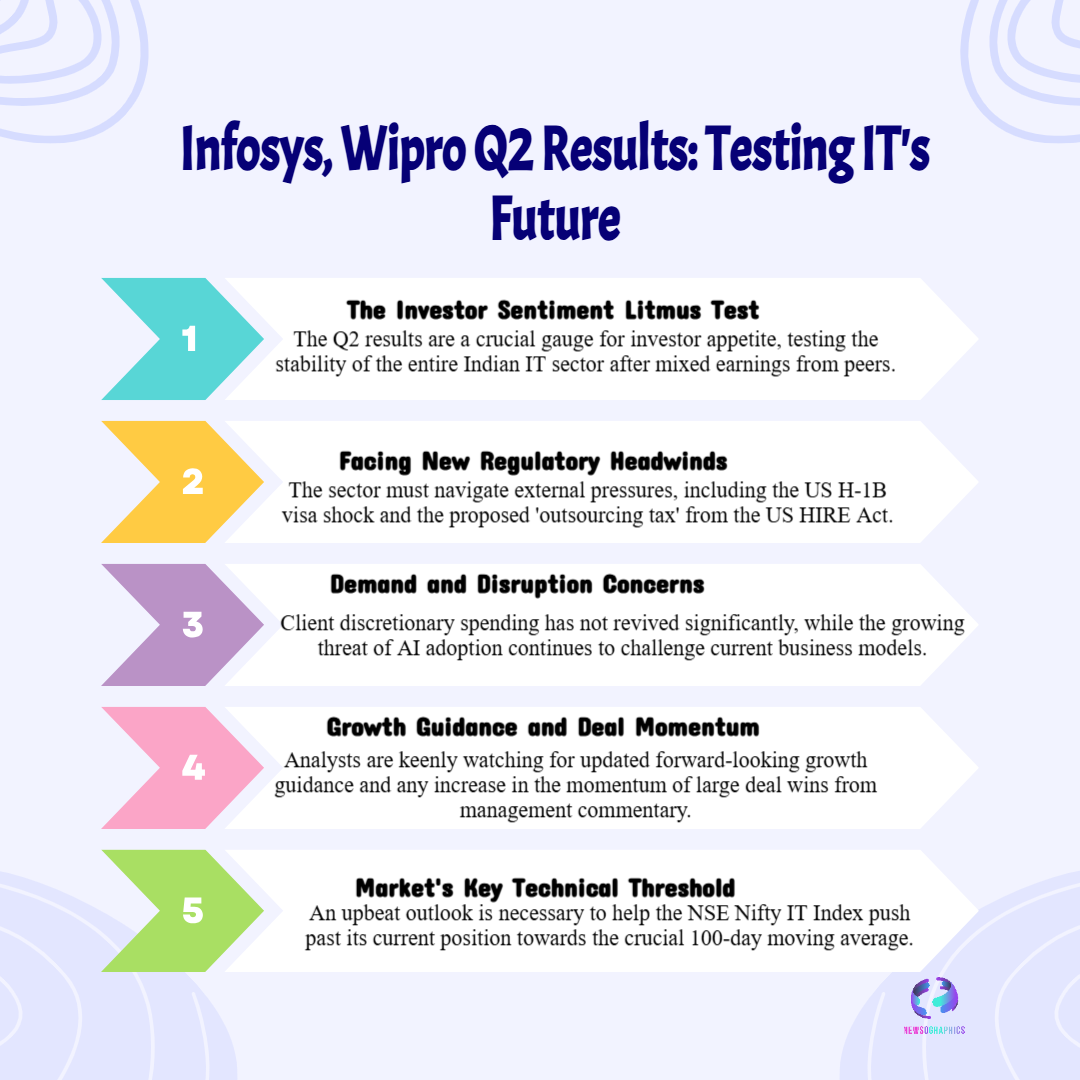

India’s IT sector faces a crucial test as Infosys and Wipro announce second-quarter results today, with investor attention fixed on revenue growth, margin trends, large-deal momentum and management guidance for the rest of fiscal 2026. After mixed results from other bellwethers earlier in the season, the two firms’ earnings and commentary will shape short-term sentiment across the NSE Nifty IT Index and influence buying interest in midcap and large-cap IT names.

Analysts polled by Bloomberg expect Infosys to report consolidated revenue of about ₹44,008 crore for Q2, a quarterly rise near 4%, with EBIT seen around ₹9,338 crore and net profit estimated at roughly ₹7,222 crore. Investors will parse any changes in EBIT margin — forecast to tick up by about 39 basis points — as a sign of pricing power and operating leverage in an environment where client discretionary budgets remain cautious. Commentary on large-deal pipelines, pipeline conversion rates and the health of the financial-services vertical will be especially watched.

Wipro’s Q2 estimates similarly hold the market’s gaze: revenue expectations stand near ₹22,680 crore, with net profit forecasts around ₹3,278.6 crore and an expected EBIT margin in the mid-teens. For Wipro, management remarks on deal wins, the performance of digital and cloud services, and margin expansion levers — such as productivity programs or pricing adjustments — will determine whether the stock can sustain any post-results rally. Investors will also compare execution across peer groups to judge which companies are best placed to capture enterprise digital spend.

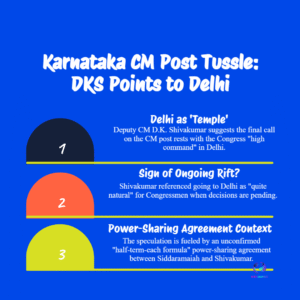

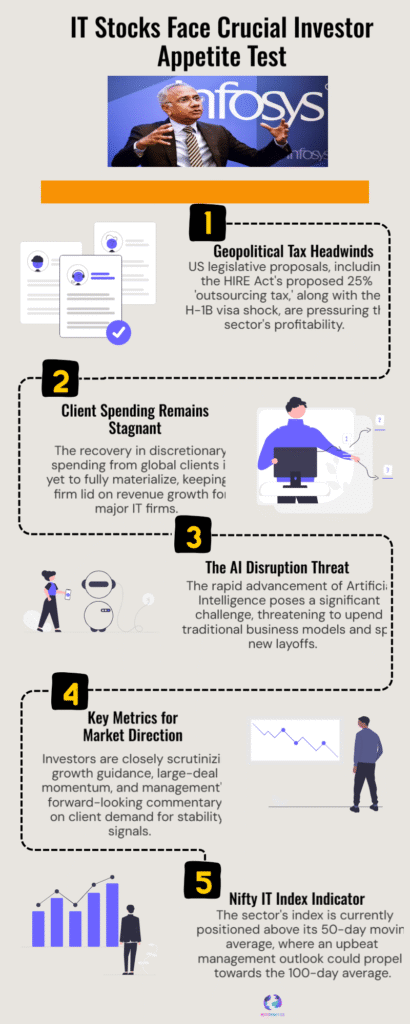

Beyond quarterly numbers, sector risks are front and centre. The industry is navigating prolonged uncertainty from U.S. policy shifts — including recent H-1B visa shocks and the proposed HIRE Act’s outsourcing tax — which could reshape sourcing economics and client sourcing decisions. At the same time, generative AI presents both a demand catalyst and a competitive disruptor: while AI-led transformation can unlock new contract value, it is also prompting clients to re-evaluate traditional outsourcing models, invest selectively, and push for outcomes-based pricing.

Market technicians note the NSE Nifty IT Index remains above its 50-day moving average, and a confident outlook from Infosys and Wipro could drive a move toward the 100-day average — a technical shift that would attract momentum buyers. Conversely, cautious guidance or weaker-than-expected large-deal updates would likely trigger profit-taking, given recent volatility in IT valuations and concerns around client discretionary spend. Investor focus will therefore be both quantitative — revenue, margins, order books — and qualitative — management tone on demand and deal momentum.