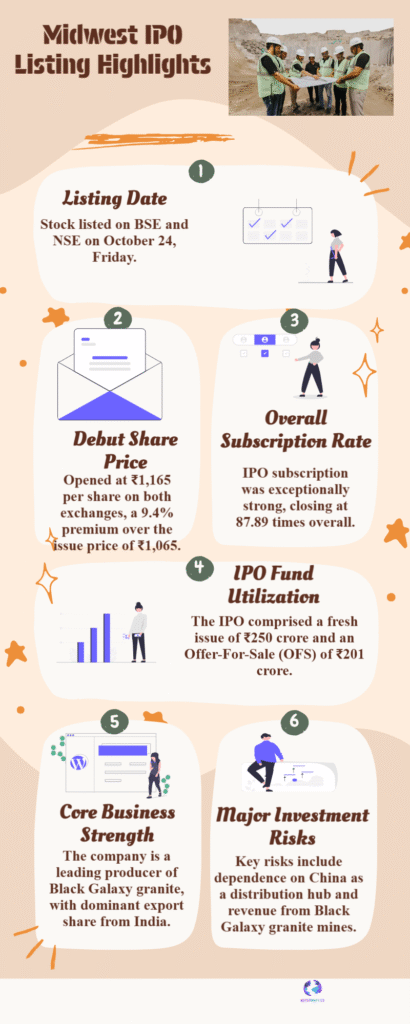

Midwest Ltd debuts on NSE & BSE at ₹1,165, about 9% above the issue price; IPO proceeds will fund capacity expansion and reduce debt. Allotment and GMP details inside.

Midwest Ltd made a solid market debut on October 24, listing on the NSE and BSE at ₹1,165 — roughly 9% above the issue price of ₹1,065 — after a well-subscribed IPO that attracted strong retail interest and upbeat grey-market indications. The public issue comprised a fresh issue of ₹250 crore and an offer-for-sale of ₹201 crore; allotment was completed on October 20 and shares began trading in the special pre-open session on listing day.

The company is a leading exporter of premium natural stone, owning multiple granite mines in Telangana and Andhra Pradesh and notable for its Black Galaxy granite. Market analysts say the listing gain reflects investor appetite for export-linked midcap stories and the scarcity premium attached to unique stone deposits. Near term, watch factors such as quarterly export volumes, realisations for key stone varieties, and working-capital trends — these will determine whether the post-listing premium endures.

For investors hunting specific queries, useful long-tail phrases embedded here are “Midwest IPO allotment status October 2025,” “Midwest GMP today ₹115,” “how Midwest will use IPO proceeds,” and “Midwest share price NSE debut.” Short-tail, high-traffic keywords included naturally are “Midwest IPO,” “Midwest share price,” and “natural stone exporter IPO.” Practical advice: IPO investors should monitor post-listing volatility, check sponsor lock-in schedules, and track export demand from key markets like China and the US to gauge medium-term performance.