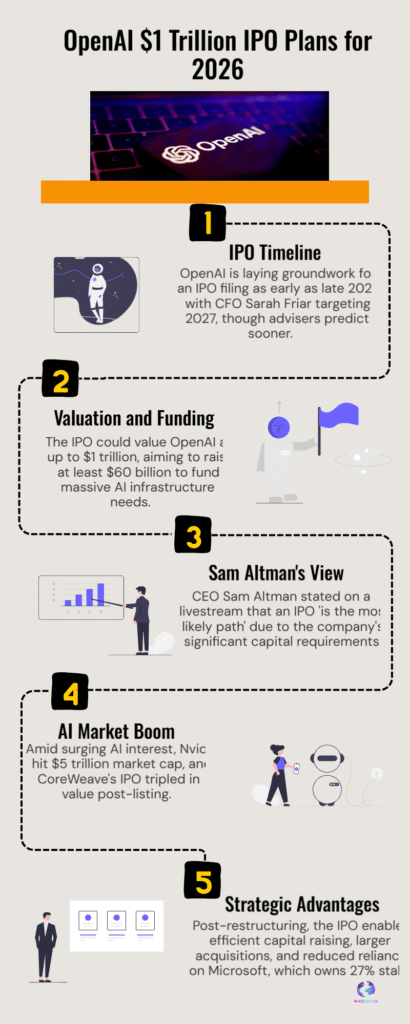

OpenAI is laying groundwork for a blockbuster IPO, with Sam Altman said to be preparing for a 2026 filing that could value the company at up to $1 trillion and target at least $60 billion in capital raises. Read what this means for investors, Microsoft and the AI market.

OpenAI’s Next Growth Phase

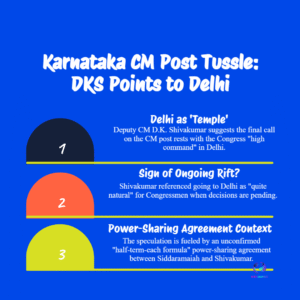

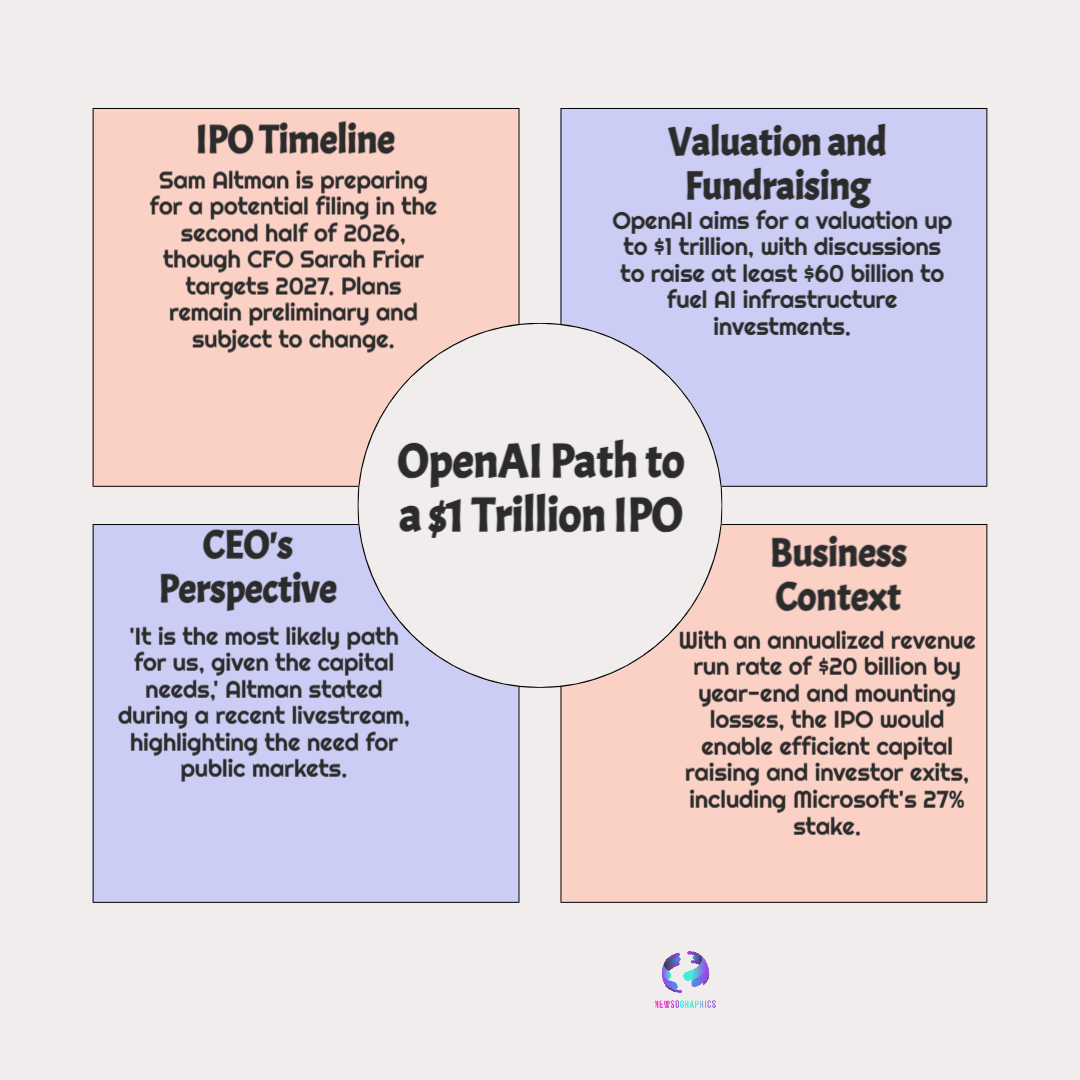

OpenAI has quietly begun preparing for a potential initial public offering that could value the company at as much as $1 trillion, with discussions pointing to a regulatory filing as early as the second half of 2026. People familiar with the matter say the company is looking at raising at least $60 billion in the IPO.

The move follows a corporate reorganisation that left the OpenAI Foundation holding a significant stake while Microsoft remains a major external investor; reports note the restructuring is part of longer-term plans to reduce single-partner dependence and unlock public capital.

CEO Sam Altman has publicly framed an IPO as the “most likely path”, but advisers and some executives caution timing could shift depending on market conditions and regulatory work — filings, valuation and timing remain subject to change. Analysts say a $1-trillion valuation would reflect lofty expectations for AI revenues and market dominance, but also concentrates scrutiny on profitability, governance and competitive risks from other cloud and model providers. Investors will be watching revenue trends, margins on enterprise contracts and how OpenAI balances rapid growth with durable governance.