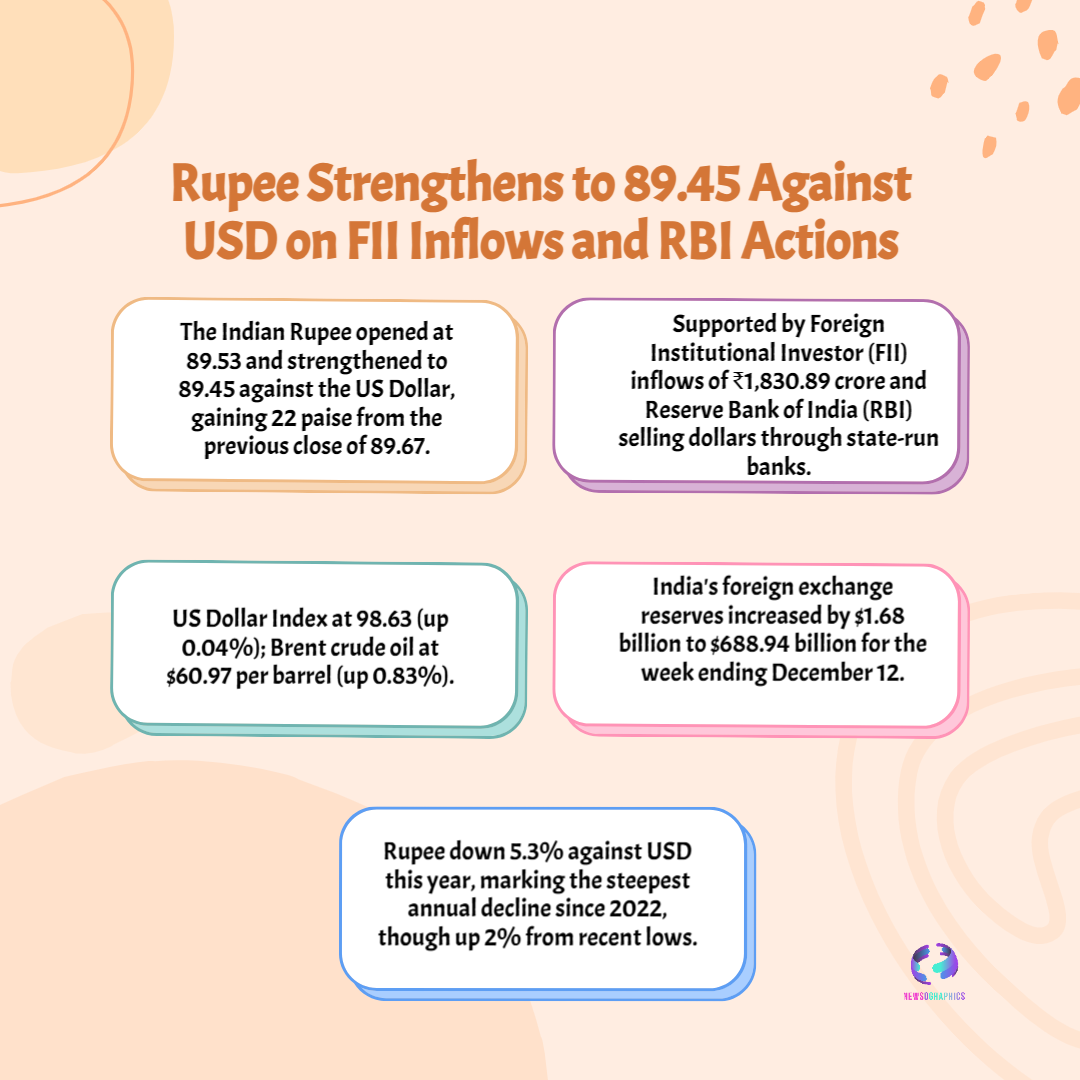

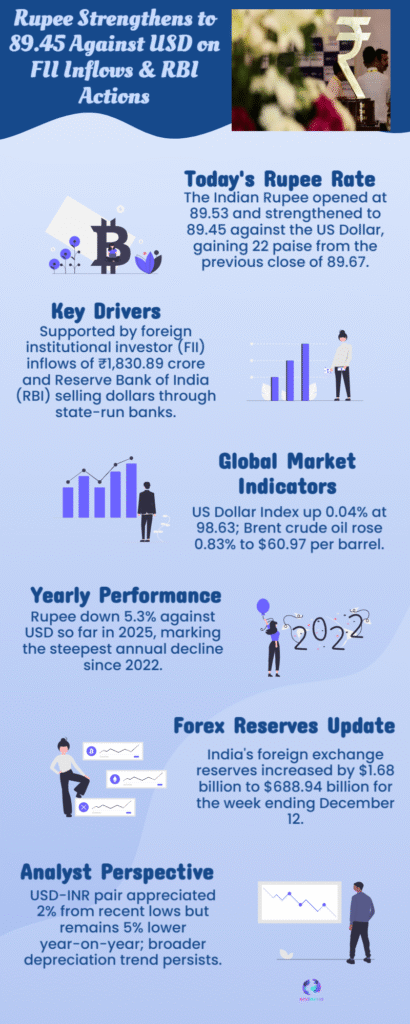

The Indian rupee firms up against the US dollar as foreign institutional inflows revive sentiment and RBI actions steady currency markets amid global volatility.

A Firmer Rupee in a Volatile Global Setting

The Indian currency has entered a phase of renewed resilience, with the Indian Rupee strengthening against the US Dollar amid shifting capital flows and calibrated central bank measures. The move reflects a broader recalibration in currency markets where domestic fundamentals are momentarily outweighing external pressures.

This appreciation comes at a time when global currencies are responding to interest rate cues, geopolitical risk, and investor appetite for emerging markets.

Role of Foreign Institutional Inflows

Capital Returning to Indian Assets

Foreign institutional investors, often seen as directional drivers of short-term currency movements, have shown renewed interest in Indian equities and debt. These inflows increase dollar supply in the domestic market, naturally lending support to the rupee.

The presence of Foreign Institutional Investors also signals confidence in India’s macroeconomic stability, reinforcing currency sentiment beyond immediate trading sessions.

Sentiment as a Currency Catalyst

Beyond sheer volumes, the psychological impact of returning foreign capital plays a critical role. A steady inflow narrative helps anchor expectations, reducing speculative pressure against the rupee during periods of global uncertainty.

RBI’s Invisible Hand in the Forex Market

The Reserve Bank of India continues to shape currency dynamics through liquidity management and strategic intervention. Rather than defending specific levels, the central bank’s approach emphasizes orderly movement and volatility control.

Market participants interpret such actions as reassurance that extreme swings—either sharp depreciation or rapid appreciation—will be smoothed to protect economic stability.

Interplay of Global and Domestic Factors

Dollar Strength and External Headwinds

Globally, the dollar remains influenced by US monetary policy expectations, bond yields, and risk-off episodes. Against this backdrop, the rupee’s firmness suggests a relative decoupling driven by domestic capital flows and controlled inflation expectations.

Domestic Fundamentals in Focus

India’s growth outlook, manageable current account dynamics, and comfortable foreign exchange reserves provide a cushion. These factors allow the rupee to respond positively when supportive triggers, such as FII inflows, align with policy stability.

Implications for Trade and Inflation

A stronger rupee carries mixed implications. Import-intensive sectors benefit from reduced input costs, while exporters face marginal pressure on realizations. On the inflation front, currency appreciation helps moderate imported inflation, offering policymakers additional breathing room.

This balance reinforces why authorities prefer gradual currency movements rather than abrupt shifts that could destabilize trade planning.

Market Outlook and Currency Trajectory

Currency strategists view the rupee’s recent strength as a reflection of improved near-term sentiment rather than a structural shift. Sustaining gains will depend on the durability of foreign inflows, global risk appetite, and the RBI’s continued calibration of liquidity.

In this environment, the rupee’s trajectory is less about chasing highs and more about maintaining stability amid cross-currents.

Conclusion: Stability Over Spectacle

The rupee’s strengthening against the dollar underscores a convergence of supportive forces—renewed foreign investment interest and steady central bank oversight. While global uncertainties persist, the current movement highlights India’s ability to anchor its currency through fundamentals and policy credibility.

Rather than dramatic appreciation, the signal from markets is clear: stability, backed by confidence and measured intervention, remains the defining objective of India currency strategy.