Complete 2025 guide to Tata Motors demerger tax implications: cost allocation, holding period, LTCG/STCG rules, dividend TDS and what shareholders should do next.

Tata Motors Demerger

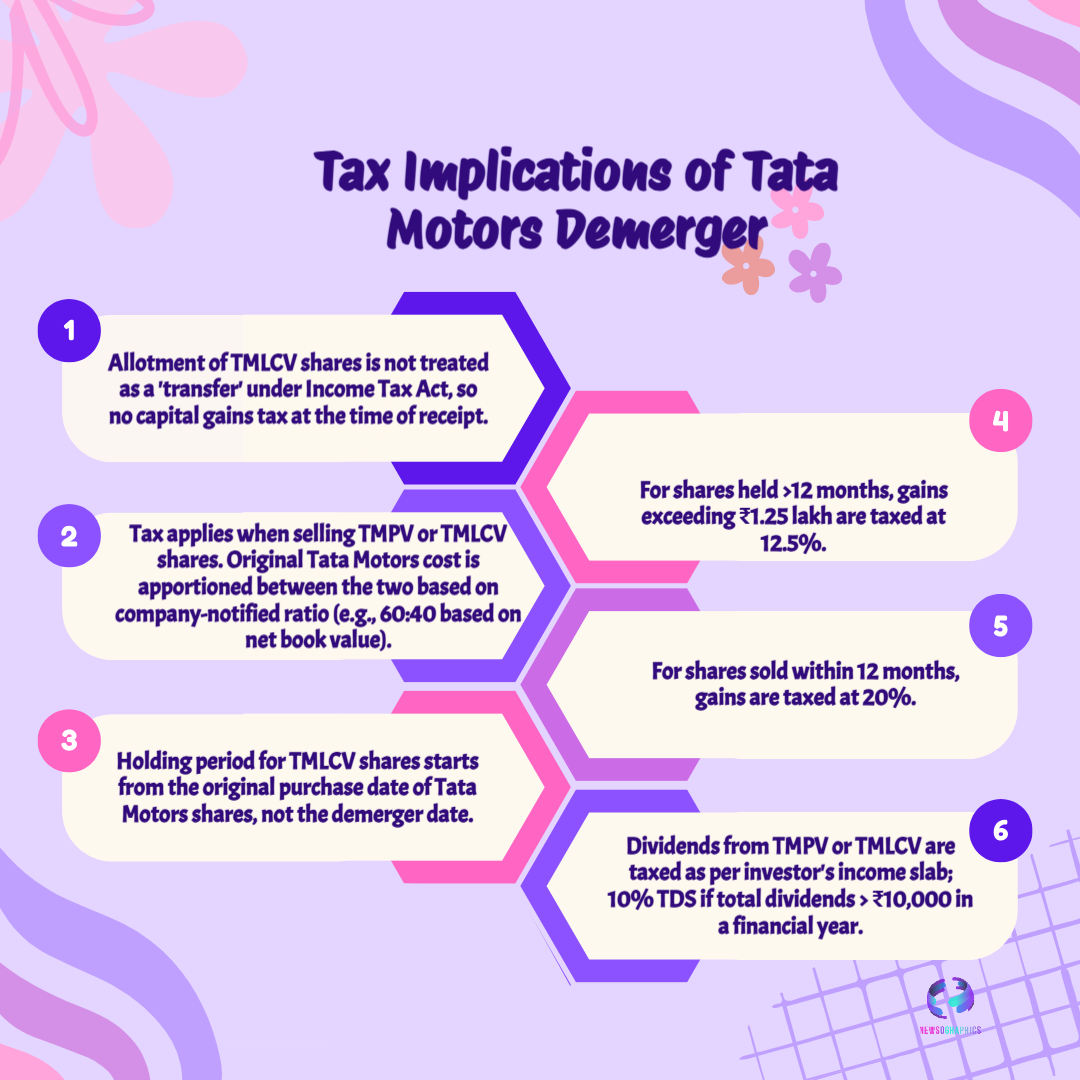

Tata Motors demerger that created TMLCV and TMPV is now effective, and shareholders should act carefully to avoid tax pitfalls. Investors who held Tata Motors shares on the record date — October 14, 2025 — were allotted one TMLCV share per Tata Motors share, while the legacy listed stock was rebranded as Tata Motors Passenger Vehicles. The new TMLCV listing is expected in November 2025.

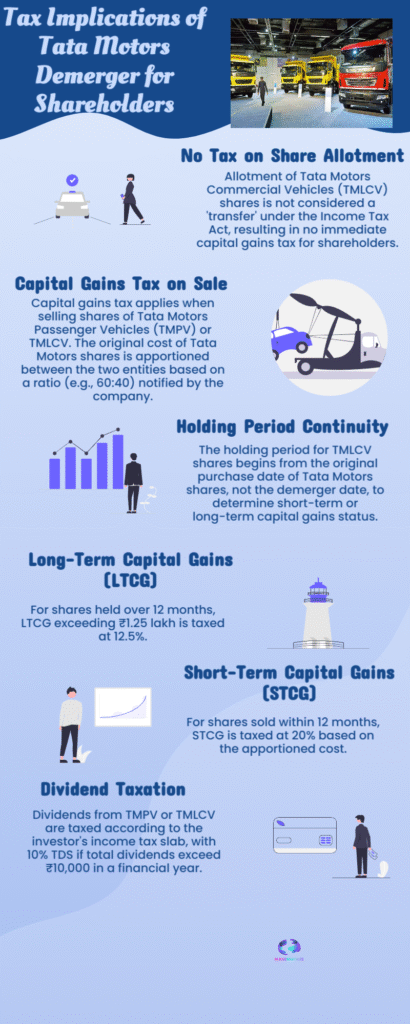

Importantly, the allotment of TMLCV shares does not trigger immediate capital gains tax, because such allotment is not treated as a transfer under current tax rules. Tax events typically occur only when shareholders sell shares in either demerged entity. To compute capital gains correctly, investors must apportion their original purchase cost between TMLCV and TMPV using the cost-allocation ratio that the registrar (RTA) will publish. This ratio is usually based on net book value, not market price; early indications point to a potential 60:40 split, but shareholders must wait for the official figure before filing.

Another critical tax point is the holding period: the original purchase date of Tata Motors shares is carried forward to determine whether gains qualify as long-term capital gains (LTCG) or short-term capital gains (STCG). Selling without checking the carried-forward holding period can convert expected LTCG into higher-taxed STCG. Dividend income from either company will be taxed per an investor’s slab and may attract TDS and reporting obligations if thresholds are crossed.

Shareholders should retain proof of original purchase, demat statements, and the RTA’s cost allocation notice. Consult a tax advisor before selling to optimise tax outcomes and avoid scrutiny.