India’s new Code on Social Security mandates aggregators like Swiggy and Zomato to contribute 1-2% of annual turnover to a Gig Worker Welfare Fund. Learn how this historic rule provides portable PF, ESIC, and insurance to millions of delivery partners nationwide.

Gig Worker Social Security India Labour Codes

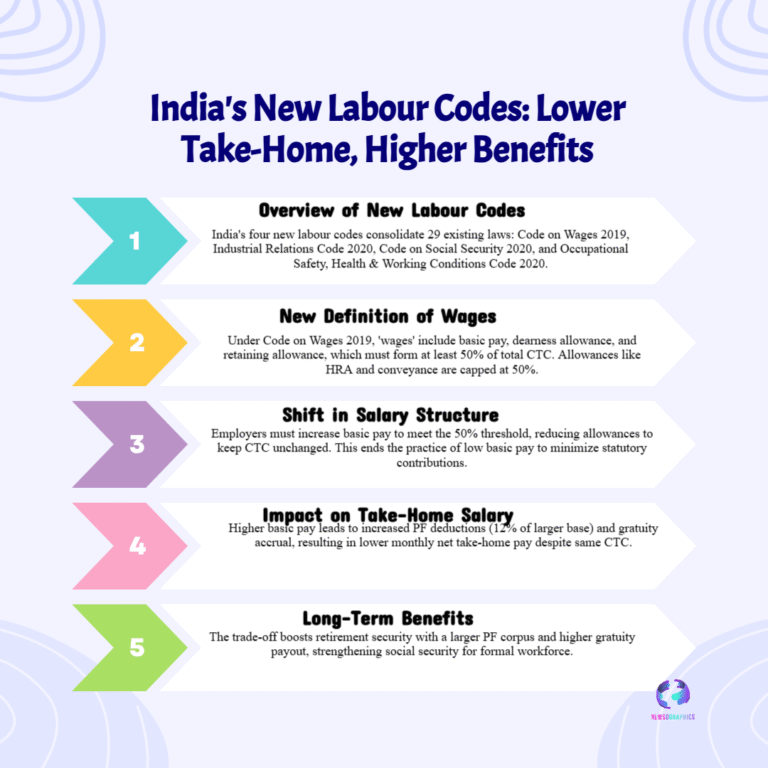

The Indian government’s implementation of the four new Labour Codes, consolidating 29 fragmented laws, has ushered in a transformative era for the country’s estimated one crore gig workers. For the first time, app-based delivery partners, ride-hailing drivers, and other platform workers—the backbone of companies like Swiggy, Zomato, Uber, and Amazon—are moving from the fringes of the unorganized sector into a legally recognized social security net.

The linchpin of this historic change is the Code on Social Security, 2020. This legislation formally defines terms like ‘gig worker,’ ‘platform worker,’ and ‘aggregator’ and establishes clear legal duties for the platforms themselves. The biggest requirement, and the most crucial shift for the business models of these tech giants, is the mandatory financial obligation placed on the aggregators.